Ever found yourself in a situation where a friend or family member needs a little financial assistance, or perhaps you are lending money to someone you trust for a specific purpose? While good intentions are usually at the heart of these transactions, a clear understanding is absolutely crucial to prevent misunderstandings or strained relationships down the road. It is about setting clear expectations for everyone involved.

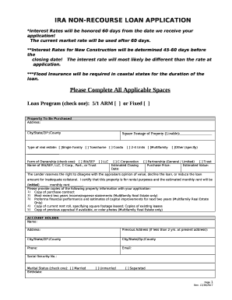

That is where an unsecured personal loan agreement template comes in incredibly handy. This essential document provides a structured framework to outline the precise terms of the loan, ensuring both the borrower and the lender are completely on the same page from the very beginning. It is not just for formal financial institutions; it is an incredibly valuable tool for private loans between individuals too.

Unlike secured loans, which involve a tangible asset or collateral to guarantee the repayment, an unsecured personal loan relies solely on the borrower’s promise and ability to repay. This fundamental difference makes a detailed written agreement even more vital, as it serves as the primary legal record of the agreement and the specific commitments made by both parties. It helps protect everyone involved.

Key Elements to Include in Your Unsecured Personal Loan Agreement

Crafting a robust loan agreement ensures that all bases are thoroughly covered and understood. It might seem like a lot of detail at first glance, but taking the time to meticulously outline everything upfront can save a great deal of stress, confusion, and potential conflict later on. Think of it as creating a comprehensive roadmap for the entire repayment journey, leaving no room for ambiguity.

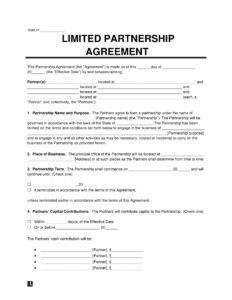

First and foremost, the agreement should clearly and unambiguously identify both the lender and the borrower. This includes their full legal names and current residential addresses. You want absolutely no ambiguity about who is receiving the funds and who is providing them. This foundational step is critical for the validity and enforceability of any legal document.

Then, of course, the exact loan amount must be stated in clear numerical and written form. Always specify the currency involved, whether it is US Dollars, Euros, or another denomination. Additionally, the repayment schedule is paramount. Will the loan be repaid as a single lump sum on a specific date, or will there be regular installments? If installments, detail the precise frequency, such as weekly or monthly, and the exact calendar date each payment is due.

Interest rates, if they are applicable to the loan, need to be clearly defined. Even if it is an interest free loan, explicitly stating “no interest will be charged” is an important clarification. If there is interest, specify the annual percentage rate APR and precisely how it will be calculated and applied to the principal balance over time. Transparency here is key.

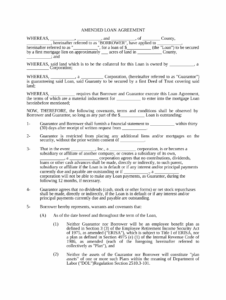

What happens if a payment is missed or delayed? Late fees or penalties should be thoroughly outlined within the agreement. This serves to encourage timely payments and provides a clear framework for addressing any instances of default. The agreement should also cover acceleration clauses, explaining what happens if the borrower fails to make several consecutive payments, potentially making the entire outstanding balance immediately due.

Essential Clauses to Consider

Beyond the foundational basics, several other clauses can significantly strengthen the overall agreement and provide further protection for both parties.

- Governing Law: Specify which state or country’s laws will govern the interpretation and enforcement of the agreement. This is incredibly important for determining jurisdiction in the event of any dispute resolution.

- Entire Agreement: Include a clause stating that this document represents the complete and final understanding between the parties and that it supersedes any prior oral or written discussions, agreements, or negotiations.

- Amendment: Clearly outline how the agreement can be changed or modified in the future. Typically, this requires a written consent and signature from both parties involved.

- Severability: If one particular part or provision of the agreement is found to be invalid or unenforceable by a court of law, this clause ensures that the rest of the agreement remains valid and in full effect.

- Signatures: Both parties must sign and date the agreement. For added legal weight and protection, it is highly advisable to have the signatures witnessed by a third party or even notarized.

Why an Unsecured Personal Loan Agreement Template Simplifies the Process

The idea of drafting a comprehensive legal document from scratch can certainly feel overwhelming and daunting for many individuals. This is precisely why utilizing an unsecured personal loan agreement template is such a smart and efficient move. It provides a professional, legally sound, and ready made starting point, effectively saving you significant amounts of time, effort, and potential stress.

A well designed template already incorporates most of the necessary legal jargon, standard clauses, and essential provisions that you might not think of on your own. It acts as a thorough checklist, ensuring that you do not inadvertently overlook any critical details that could potentially lead to misunderstandings, disputes, or even legal complications further down the line. You simply fill in the specific details of your unique loan arrangement.

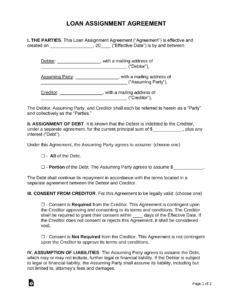

Customization is absolutely key when working with any template. While a template offers the crucial structure and foundational framework, you still maintain the full flexibility to tailor it precisely to your exact needs and the specific circumstances of your loan. Whether it is adjusting repayment terms, adding specific conditions for default, or including details about the intended purpose of the loan, the template serves as a robust foundation upon which you can build your perfectly personalized agreement.

Having a clear, written agreement for any personal loan, especially an unsecured one, is a clear testament to responsible lending and borrowing practices. It actively fosters transparency between the parties, provides vital protection for both the lender and the borrower, and lays the essential groundwork for a smooth, predictable, and fair financial transaction from start to finish.

By taking the time to properly document all the terms and conditions, you are not only safeguarding your financial interests but also actively preserving relationships that might otherwise be severely strained or damaged by misunderstandings or disagreements about money. It is a relatively small effort upfront with truly significant and lasting long term benefits for everyone involved.