In today’s interconnected financial world, transactions often extend beyond the simple two-party exchange. Whether it’s a family member helping with a bill, a business facilitating payment on behalf of a client, or an organization managing funds for a beneficiary, these arrangements introduce an extra layer of complexity. Ensuring clarity and protection for everyone involved becomes paramount to avoid misunderstandings and potential disputes down the line.

That’s where a robust third party payment agreement template comes into play. It acts as a clear roadmap, outlining the roles, responsibilities, and expectations of each party in a multi-faceted financial arrangement. This document isn’t just a formality; it’s a vital tool designed to bring structure and peace of mind to what could otherwise be a confusing process, establishing terms that benefit everyone and prevent future headaches.

Imagine the ease of mind knowing every detail, from payment schedules to default clauses, is meticulously documented and agreed upon. Such an agreement not only fosters trust among the parties but also provides a legal framework that can be referenced should any unforeseen issues arise, making complex financial interactions much smoother and more secure for all.

Navigating the Nuances of Third Party Payments

Third-party payments are essentially any financial transaction where an entity other than the primary debtor or creditor is involved in the payment process. Think of a parent paying for their adult child’s rent, a company settling an invoice for a subsidiary, or a charity receiving funds from a donor specifically earmarked for a particular beneficiary. While the intent is usually good, the lack of a formal understanding can quickly lead to ambiguity, miscommunication, and financial strain for one or more parties involved.

Many people embark on these arrangements with a handshake and good intentions, assuming that because the parties know each other well, a written agreement isn’t necessary. However, life has a way of throwing curveballs. Relationships can change, financial situations can shift unexpectedly, and memories can fade or differ. Without a clear, documented agreement, these shifts can transform a helpful gesture into a stressful conflict, leaving everyone wondering about their legal standing and financial obligations.

This is precisely why a comprehensive agreement is crucial. It serves as a single source of truth, detailing the scope of the payment, the duration of the arrangement, and what happens in various scenarios. It moves the agreement from a verbal understanding, which can be easily misinterpreted, to a legally binding document that everyone can refer back to, fostering transparency and accountability.

Key Elements to Include in Your Agreement

A well-drafted third-party payment agreement should meticulously cover several key areas to ensure maximum clarity and protection. Each section plays a vital role in defining the relationship and outlining the operational aspects of the payment arrangement, leaving little room for misinterpretation.

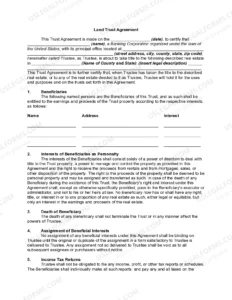

- Identification of All Parties: Clearly define who is the payer (the third party), who is the recipient (the entity receiving the money), and who is the beneficiary (the entity for whom the payment is being made). Full legal names and addresses are essential.

- Payment Details: Specify the exact amount of money to be paid, the frequency of payments (e.g., weekly, monthly, one-time), the method of payment (e.g., bank transfer, check), and any specific dates or deadlines.

- Duration of Agreement: Outline when the arrangement officially begins and when it is expected to conclude. This can be a fixed period, until a certain amount is paid, or until a specific condition is met.

- Default Clauses: What happens if a payment is missed, delayed, or incomplete? Clearly define the consequences, such as late fees, interest, or the termination of the agreement.

- Dispute Resolution: Establish a clear process for how any disagreements or conflicts will be handled, whether through mediation, arbitration, or legal action.

- Governing Law: Indicate which jurisdiction’s laws will govern the interpretation and enforcement of the agreement, which is especially important if parties reside in different areas.

By meticulously addressing each of these points, the agreement transforms from a simple understanding into a robust, legally enforceable document that safeguards the interests of all involved. It ensures that everyone is on the same page, significantly reducing the likelihood of future disputes and providing a clear path forward should any issues arise.

Who Benefits from a Third Party Payment Agreement?

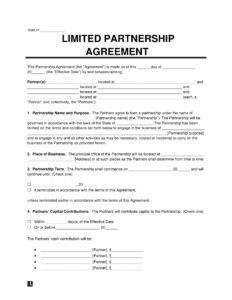

Virtually anyone involved in a financial arrangement where one person or entity pays on behalf of another stands to benefit from a clear agreement. This includes a wide array of scenarios, from personal family matters to intricate business transactions. Individuals might use it when contributing to a loved one’s educational expenses or medical bills. Small businesses could employ it when a parent company is covering operating costs for a startup venture. Even large corporations might utilize such a structure when one division or partner company is settling debts for another, streamlining inter-company financial flows.

Consider the specific scenarios where this type of agreement proves invaluable. A college student might have their parents cover their tuition and housing directly to the institution or landlord; a formal agreement clarifies the terms of this financial support, perhaps outlining repayment expectations or conditions. Similarly, a business partner might step in to cover a struggling venture’s operational costs temporarily, and an agreement ensures that these funds are properly accounted for and understood as either a loan, an investment, or a gift. The explicit documentation prevents future ambiguity and potential legal entanglements.

Ultimately, a well-crafted agreement helps to protect the financial interests and personal relationships of all parties. It removes guesswork, provides a clear record, and sets expectations, making complex financial relationships manageable and secure. It offers peace of mind, knowing that the terms are transparent and agreed upon, regardless of the nature of the relationship between the payer, beneficiary, and recipient.

- Family members managing shared expenses or providing financial support.

- Businesses facilitating payments on behalf of clients, subsidiaries, or partners.

- Charitable organizations receiving payments from third parties for beneficiaries.

- Individuals in debt settlement arrangements where a third party assists.

Having a structured document in place for any third-party payment situation is not just about legal protection; it’s about fostering clarity, trust, and predictability. It ensures that every party involved understands their role and the flow of funds, significantly reducing the potential for disputes and making financial interactions smoother for everyone. Such agreements serve as a cornerstone for healthy, transparent financial relationships.

Embracing the use of such a template translates directly into greater financial security and peace of mind. It transforms potentially vague or complicated multi-party payment scenarios into straightforward, manageable processes, allowing all involved to focus on their primary goals without the added stress of financial uncertainty or disagreement. This proactive approach to financial arrangements is truly an investment in future stability and amicable relationships.