Navigating the complex world of oil and gas transactions can feel like traversing a vast desert without a map. Whether you are buying or selling interests in wells, leases, or equipment, the stakes are incredibly high. These deals involve significant capital, intricate legal structures, and a myriad of potential pitfalls that can jeopardize even the most promising ventures. That’s why having a robust legal framework is not just a luxury, but an absolute necessity for all parties involved.

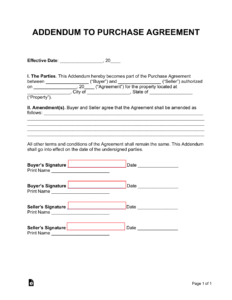

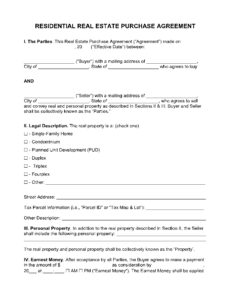

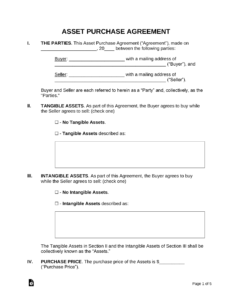

A well-drafted legal document acts as the backbone of any successful transaction in this demanding industry. It clearly defines the rights, responsibilities, and expectations of both the buyer and the seller, ensuring transparency and reducing the likelihood of future disputes. When you are looking to secure your interests and make sure every detail is accounted for, finding a reliable oil gas purchase sale agreement template becomes paramount. Such a template provides a structured starting point, helping you to cover all the essential bases without having to build a document from scratch.

This article aims to shed light on what makes these agreements so vital, what key elements they should contain, and how they contribute to a smooth and successful transfer of assets in the dynamic oil and gas sector. We will explore the critical clauses and considerations that ensure your interests are protected and the transaction proceeds without unexpected hitches.

Understanding the Cornerstone: Key Elements of an Oil and Gas Purchase and Sale Agreement

At its heart, an oil and gas purchase and sale agreement (PSA) is a legally binding contract that outlines the terms and conditions for the transfer of oil and gas properties from one party to another. These properties can include anything from working interests, royalty interests, mineral leases, wells, equipment, and even associated contracts like operating agreements or gas gathering agreements. It’s a comprehensive document designed to protect both the buyer and the seller throughout the entire transaction lifecycle.

The complexity of a PSA reflects the inherent complexities of the oil and gas industry itself. Unlike a simple real estate transaction, you are not just buying land; you are acquiring rights to extract resources, along with all the operational, environmental, and regulatory responsibilities that come with them. This means the agreement must be incredibly detailed, leaving no room for ambiguity about what is being bought, how much is being paid, and under what conditions the transfer will occur.

Think of it as the blueprint for the entire deal. It starts by identifying the parties involved – the seller who owns the assets and the buyer who wishes to acquire them. From there, it meticulously details the assets being conveyed, which can often require extensive schedules and exhibits listing every single lease, well, or piece of equipment down to specific serial numbers. This precision is vital to prevent any misunderstandings about the scope of the transaction.

Crucial Provisions You’ll Find in a Template

A comprehensive oil gas purchase sale agreement template will typically include several critical sections that define the terms of the transaction. Understanding these elements is essential for customizing the template to fit your specific deal.

- **Purchase Price and Payment Terms:** This section specifies the total amount the buyer will pay, how it will be paid (cash, stock, deferred payments), and any adjustments that might occur based on factors like production volumes or operating expenses between the effective date and the closing date.

- **Representations and Warranties:** Both parties make certain factual statements about the assets and their own legal standing. The seller might warrant that they have good title, that the wells are producing as represented, or that there are no undisclosed environmental liabilities. The buyer might warrant their ability to close the deal. These are crucial for allocating risk.

- **Covenants:** These are promises made by the parties to do or not do certain things before and after closing. For example, the seller might covenant to operate the properties in the usual course of business prior to closing, while the buyer might covenant to assume certain liabilities post-closing.

- **Conditions to Closing:** These are events that must occur before the transaction can be finalized. Common conditions include obtaining necessary regulatory approvals, the accuracy of representations and warranties, and the absence of material adverse changes to the assets.

- **Indemnification:** This clause outlines how and when one party will compensate the other for losses arising from breaches of the agreement, environmental liabilities, or other specific risks identified in the contract. It’s a key risk allocation tool.

- **Environmental Provisions:** Given the nature of the industry, PSAs often contain detailed environmental indemnities, disclosures, and sometimes even specific environmental assessments or cleanup responsibilities.

Beyond these core elements, other provisions will address confidentiality, governing law, dispute resolution mechanisms, and the allocation of expenses. Every clause plays a vital role in creating a balanced and enforceable agreement, protecting all parties involved from unforeseen challenges.

The Indispensable Role of Due Diligence

Before any oil and gas transaction can be finalized, a thorough due diligence process is absolutely critical. This isn’t just a recommendation; it’s a mandatory step that allows the buyer to investigate the assets being purchased in detail, verifying the seller’s representations and identifying any potential issues or liabilities. Without proper due diligence, a buyer risks acquiring properties with unforeseen problems that could significantly devalue their investment or lead to costly legal battles down the road.

Due diligence involves a deep dive into various aspects of the oil and gas properties. This typically includes reviewing title documents to ensure the seller has clear ownership and that there are no encumbrances, liens, or disputes that could affect the buyer’s rights. Production records are meticulously analyzed to confirm historical output and estimate future reserves, which directly impacts the valuation. Operational records are scrutinized to understand the condition of equipment, past maintenance, and compliance with safety standards.

Furthermore, environmental assessments are paramount. Buyers need to understand the historical environmental performance of the assets, identify any spills, contamination, or regulatory non-compliance issues that could lead to significant cleanup costs or penalties. Contracts related to the properties, such as joint operating agreements, marketing agreements, and transportation contracts, also need careful review to understand ongoing obligations and potential liabilities. This meticulous examination ensures that the buyer is fully aware of what they are acquiring, allowing them to make informed decisions and, if necessary, negotiate adjustments to the purchase price or additional protective clauses in the agreement.

Safeguarding Your Investment

Ultimately, whether you are a buyer or a seller in the fast-paced oil and gas sector, a well-structured purchase and sale agreement is your most powerful tool. It ensures that complex transactions proceed smoothly, liabilities are clearly defined, and the transfer of valuable assets occurs without ambiguity. While a template provides an excellent starting point, remember that each deal is unique, requiring careful customization and often, the expert eyes of legal professionals experienced in energy law.

Taking the time to understand every clause, negotiate terms diligently, and conduct thorough due diligence will not only protect your financial interests but also lay the groundwork for a successful and lasting venture in the oil and gas industry. An agreement meticulously tailored to your specific situation is the best way to secure your future in this dynamic field.