Starting a new business venture in North Carolina as a Limited Liability Company, or LLC, is an exciting step. You have likely spent countless hours planning your product or service, developing your brand, and envisioning your future success. While many entrepreneurs focus on external marketing and operations, it is equally important to lay down clear internal groundwork that will protect your business and its members for years to come.

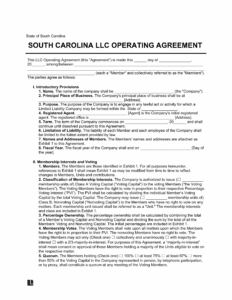

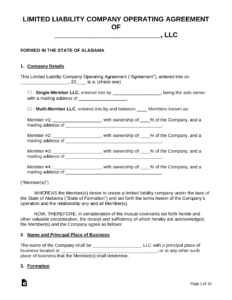

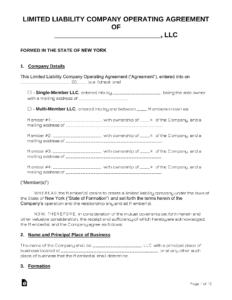

One of the most crucial internal documents for any LLC is an operating agreement. Think of it as the foundational blueprint for how your company will be run, outlining everything from member responsibilities to profit distribution. Even though North Carolina law does not explicitly mandate that an LLC must have a written operating agreement, creating one is an absolute best practice and a smart move for any business owner. Finding a reliable north carolina llc operating agreement template can save you time and ensure you cover all the essential bases.

This document acts as a binding contract among the members, preventing future misunderstandings and providing a clear path forward during disagreements. It empowers you to customize your LLC’s structure and governance, rather than relying on default state laws that might not perfectly align with your vision. Investing time in crafting a solid operating agreement now can prevent headaches and costly disputes down the road, ensuring a smoother operation as your business grows.

Why Your North Carolina LLC Needs an Operating Agreement

Even if you are a sole proprietor operating a single-member LLC in North Carolina, an operating agreement is still incredibly valuable. It strengthens your legal standing, further separating your personal assets from your business liabilities. This document demonstrates that your LLC is a legitimate, distinct entity, which is crucial for maintaining the personal liability protection that an LLC structure is designed to provide. Without it, in certain legal challenges, a court might “pierce the corporate veil,” meaning your personal assets could be at risk.

For multi-member LLCs, the importance of an operating agreement cannot be overstated. Imagine a partnership where all initial understandings are verbal. What happens when a significant decision needs to be made, or when one member wants to leave the business? Without a written agreement, these situations can quickly devolve into confusion, conflict, and potentially expensive legal battles that drain resources and emotional energy. The operating agreement serves as a comprehensive guide, providing clear procedures for nearly every scenario your business might encounter.

Defining Roles and Responsibilities

A well-crafted operating agreement clearly defines the roles, responsibilities, and rights of each member. This prevents ambiguity and ensures everyone knows what is expected of them, fostering a more harmonious and productive working environment. It outlines the specific duties each member has, whether they are managing operations, handling finances, or contributing in other ways.

Here are some key areas an operating agreement addresses regarding roles and responsibilities:

- Capital contributions: How much each member invests in the LLC.

- Profit and loss distribution: How profits and losses are shared among members.

- Management structure: Whether the LLC is member-managed or manager-managed.

- Voting rights: The process for making major decisions and how votes are weighted.

- Buy-sell provisions: What happens if a member wants to sell their interest or passes away.

Beyond outlining responsibilities, the operating agreement also dictates the decision-making process for your LLC. It establishes how meetings will be held, what constitutes a quorum, and the voting thresholds required for different types of decisions, whether it is electing a new manager or approving a major acquisition. This structure ensures that critical business matters are handled efficiently and fairly, with clear guidelines for resolving disagreements among members.

Ultimately, having a comprehensive operating agreement protects your investment, your relationships with fellow members, and the longevity of your business. It acts as a safety net, allowing you to focus on growing your North Carolina LLC with confidence, knowing that the internal governance is solid and clearly articulated.

Key Components of a Robust Operating Agreement

While every business is unique, a strong operating agreement will typically include several core sections that address fundamental aspects of the LLC’s operation and governance. These components are vital for providing clarity and preventing future disputes. Understanding these elements will help you make the most of a north carolina llc operating agreement template.

A crucial part of the agreement details capital contributions and how profits and losses will be allocated. This section clarifies how much money, property, or services each member contributes to the LLC, and perhaps more importantly, how the financial gains and losses of the business will be distributed among them. This might not always be proportional to ownership, which is why having it explicitly stated in writing is essential.

Furthermore, a comprehensive operating agreement will cover management and voting structures. It will specify if the LLC is member-managed, meaning all members participate in day-to-day decisions, or manager-managed, where a select group of managers or even one manager is responsible for operations. It also outlines the voting power of each member and the procedures for conducting votes on important business matters.

Here are other essential elements you should expect to find:

- Admission of new members: Procedures for bringing new individuals into the LLC.

- Withdrawal or expulsion of members: Guidelines for when a member leaves, voluntarily or involuntarily.

- Dissolution of the LLC: The process for winding down the business if it ceases to operate.

- Indemnification clauses: Protecting members and managers from liability under certain conditions.

These detailed provisions ensure that your North Carolina LLC can navigate changes in membership, management, and even eventual closure smoothly and according to the agreed-upon terms, without confusion or conflict.

Crafting a thorough and clear operating agreement is one of the most proactive steps you can take to safeguard your North Carolina LLC. It solidifies the foundation of your business, provides a clear roadmap for all internal operations, and protects your personal assets by reinforcing the limited liability shield. Even with a reliable template, it is always a good idea to have a legal professional review your document to ensure it accurately reflects your specific business needs and complies with all relevant state laws. This small investment can prevent significant legal challenges and ensure your business can thrive for years to come.