Starting an LLC in New York State is an exciting venture, offering a fantastic blend of flexibility and personal liability protection. Many entrepreneurs dive into the process of forming their company, securing a name, and filing the necessary paperwork with the state. While these initial steps are crucial, there’s one foundational document that often gets overlooked or postponed: the operating agreement. It’s essentially the blueprint for how your LLC will run, defining everything from member roles to profit distribution.

For anyone forming an LLC in the Empire State, understanding the importance of a well-drafted new york state llc operating agreement template is paramount. This document isn’t just a legal formality; it’s a critical tool for managing expectations, resolving disputes, and ensuring the smooth operation of your business, regardless of its size or number of members. It establishes the rules of engagement, protecting your investment and preventing future misunderstandings among members.

Think of your operating agreement as an internal constitution for your LLC. It clarifies who does what, how decisions are made, and what happens in various scenarios, from a member wanting to leave to the business potentially dissolving. Having this in place from the outset can save you significant time, money, and headaches down the road, providing a clear roadmap for all involved.

Why a New York LLC Needs an Operating Agreement (and What It Should Cover)

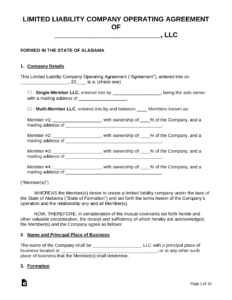

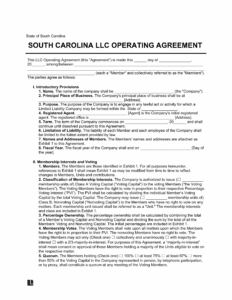

You might be surprised to learn that New York State law actually requires every LLC to have a written operating agreement, even if it’s a single-member LLC. While you don’t file it with the state, it’s a legally binding contract among the members that dictates the operational and financial understandings of the company. Without one, your LLC is subject to New York’s default rules, which might not align with your specific intentions or the unique structure of your business. These default rules are often generic and could lead to outcomes you never anticipated, especially concerning profit sharing, decision-making, or what happens if a member passes away.

The core purpose of an operating agreement is to define member roles, responsibilities, and financial arrangements. It’s where you articulate how profits and losses will be allocated, how new members can be admitted, and the procedures for a member to exit the company. This level of detail ensures everyone is on the same page from day one, fostering transparency and accountability within the organization. It’s much easier to agree on these points when the business is new and everyone is optimistic than when a dispute arises years down the line.

Consider what happens if your LLC doesn’t have an operating agreement. In the event of a disagreement or an unforeseen circumstance, state statutes will govern how your LLC operates. This can be problematic because statutory provisions might not reflect the original intentions or best interests of the members. For instance, without a clear operating agreement, profit distributions might be split equally regardless of capital contributions or workload, which could be unfair if one member invested significantly more time or money.

A robust operating agreement acts as a shield, protecting your personal assets and the integrity of the LLC. It fortifies the corporate veil, providing another layer of distinction between your personal finances and the business’s liabilities. This distinction is one of the primary reasons entrepreneurs choose the LLC structure in the first place, and a strong operating agreement reinforces that protection.

When you’re looking for a new york state llc operating agreement template, it’s important to ensure it covers all the critical bases. A good template will serve as a starting point, allowing you to customize it to fit the unique needs and agreements of your specific LLC. It should anticipate potential future scenarios and lay out a clear process for handling them.

Key Elements to Include

Finding and Customizing Your New York State LLC Operating Agreement Template

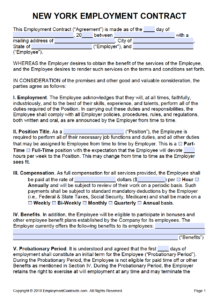

With the internet at our fingertips, finding a new york state llc operating agreement template might seem like a simple task. Many online legal service providers and business resource websites offer free or low-cost templates specifically tailored for New York. These can be excellent starting points, providing the foundational structure and many of the necessary clauses required by state law. However, it’s crucial to remember that a template is just that a starting point. It requires careful review and customization to accurately reflect your particular business arrangements and goals.

While generic templates can save time, they rarely fit every situation perfectly. Your LLC’s specific operational needs, member agreements, and financial structures will likely differ from a one-size-fits-all document. Take the time to meticulously review each section, understanding its implications for your business. For instance, if you have a multi-member LLC with varying capital contributions and responsibilities, ensure the template allows for a proportionate allocation of profits and losses, rather than a default equal split.

The customization process is where your specific agreements truly come to life. This might involve adjusting clauses related to management roles, outlining specific voting thresholds for major decisions, or detailing how future capital calls will be handled. If you’re unsure about any aspect, or if your LLC has a complex structure, consulting with a legal professional specializing in New York business law is highly advisable. They can help you navigate the nuances, ensure compliance with state regulations, and tailor the agreement to perfectly suit your business, preventing costly issues down the line.

A well-crafted and diligently customized operating agreement is one of the most vital documents your New York LLC will possess. It acts as a clear guide for all members, laying out expectations and procedures for nearly every aspect of the business. This foundational document will help avoid misunderstandings, streamline decision-making, and provide a framework for resolving any future disputes that may arise.

Taking the time to properly develop this agreement now will pay dividends in the long run, contributing significantly to the stability and success of your venture. It’s an investment in clarity and foresight, protecting your business and the relationships among its members for years to come.