Navigating the complexities of healthcare costs can be daunting for patients. Unexpected medical bills, high deductibles, and out-of-pocket expenses often leave individuals feeling overwhelmed, leading to delays in payment or even avoiding necessary treatment altogether. This financial strain is a significant challenge for both patients seeking care and medical practices striving to maintain their operational health.

This is where clear communication and structured financial solutions become invaluable. Offering flexible payment options can bridge the gap between treatment costs and patient affordability, fostering a more compassionate and understanding healthcare environment. A well-crafted payment plan helps patients manage their expenses without undue stress, ensuring they can focus on their health and recovery.

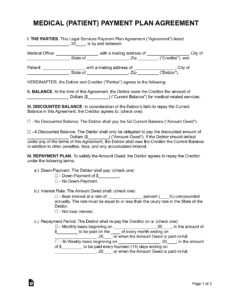

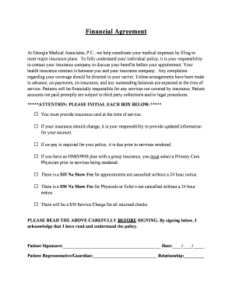

For medical offices, having a robust and easy-to-use medical office payment plan agreement template is not just about collecting payments; it is about building trust, improving patient relations, and streamlining your billing process. It provides a legal framework that protects both the patient and the practice, ensuring expectations are clear and understood from the outset.

Why Your Medical Office Needs a Solid Payment Plan Agreement Template

Implementing a standardized payment plan agreement offers numerous benefits for your medical office, extending far beyond simply ensuring financial stability. It empowers your practice to approach billing with confidence, offering solutions that cater to diverse patient needs while maintaining professional integrity. A clear agreement minimizes misunderstandings and provides a consistent approach to financial discussions, which can often be sensitive.

A well-defined payment plan helps reduce the burden of collections. Instead of chasing overdue payments or dealing with surprised patients, you have a pre-arranged, mutually agreed-upon schedule. This proactive approach saves your administrative staff valuable time and resources that would otherwise be spent on follow-ups and disputes. It also significantly lowers the chances of accounts going into collections, which can be costly and detrimental to patient relationships.

Moreover, offering transparent and manageable payment plans enhances patient satisfaction and loyalty. When patients feel understood and supported through their financial challenges, they are more likely to return for future services and recommend your practice to others. This positive reputation is invaluable in today’s competitive healthcare landscape, fostering a community of trust and reliability around your office.

A comprehensive template also ensures legal compliance and protects your practice from potential disputes. By clearly outlining terms, conditions, payment schedules, and consequences of non-payment, you establish a legally sound document. This level of clarity acts as a safeguard, providing a reference point should any questions or disagreements arise regarding the financial arrangements. It demonstrates your commitment to fairness and transparency in all financial dealings.

Essential Elements to Include in Your Template

- Patient and Practice Information: Full legal names, addresses, and contact details for both parties.

- Total Amount Due: The specific balance for which the payment plan is being established.

- Payment Schedule: Clear dates, frequency (weekly, bi-weekly, monthly), and amounts of each installment.

- Late Payment Policy: Defined penalties or fees for missed payments and grace periods, if any.

- Default Clause: What constitutes a default on the agreement and the actions the practice may take.

- Interest Rates or Fees: If any interest or administrative fees apply, they must be clearly stated.

- Signatures: Spaces for the patient or responsible party and a representative of the medical office, along with the date.

- Acknowledgement of Understanding: A statement confirming the patient has read and understood the terms.

Implementing and Customizing Your Payment Plan Agreement

Once you have a robust medical office payment plan agreement template, the next step is effectively integrating it into your practice’s operations. This involves more than just printing it out and asking for signatures; it requires training your staff, establishing clear internal policies, and ensuring consistent application. Your front desk staff and billing department should be well-versed in explaining the payment plan options and the terms of the agreement to patients in an understandable and empathetic manner.

Customizing your template to fit the specific nuances of your practice is also crucial. While a template provides a solid foundation, you might need to adjust clauses based on your local regulations, practice specialties, or the types of services you provide. For instance, a dental office might have different recurring payment needs than a physical therapy clinic. Regularly review and update your template to reflect any changes in policy, law, or practice operations to ensure it remains current and effective.

Consider creating different versions of your payment plan agreement for varying financial situations. Some patients might require a short-term, high-frequency plan, while others need a longer-term, lower-installment option. Offering flexibility within a standardized framework shows compassion and increases the likelihood of patient compliance. Remember, the goal is to make healthcare accessible while ensuring your practice remains financially viable, and a versatile template is key to achieving this balance.

Establishing clear internal guidelines for who can approve payment plans and under what circumstances is essential to maintain consistency and prevent arbitrary decisions. These guidelines should also cover how to handle missed payments, when to initiate follow-up, and the process for escalating to collections if absolutely necessary. A well-defined process protects both the patient and the practice, fostering transparency and fairness throughout the billing cycle.

Providing patients with a transparent and manageable path to pay for their care strengthens the patient-provider relationship and supports the overall health of your practice. A comprehensive and adaptable payment plan agreement is a powerful tool in achieving both financial stability and patient satisfaction, ensuring that quality healthcare remains accessible to everyone. By taking a proactive approach to financial arrangements, your office cultivates an environment of trust and mutual respect.