Starting an LLC in Maryland is an exciting venture, a step toward turning your entrepreneurial dreams into a tangible business. You have likely completed the initial formation steps with the state, perhaps even received your Employer Identification Number. While those administrative tasks are crucial, there’s one more fundamental document that often gets overlooked, yet it is absolutely vital for the smooth operation and legal protection of your business: the operating agreement.

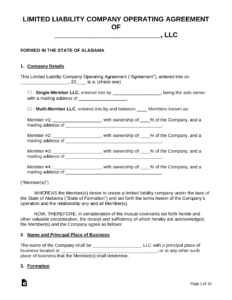

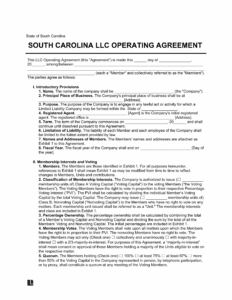

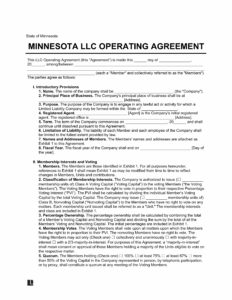

This internal document serves as the blueprint for how your Maryland Limited Liability Company will be managed, how decisions will be made, and how profits and losses will be distributed among its members. Finding a reliable maryland llc operating agreement template can streamline this process, ensuring you cover all the necessary bases without having to draft everything from scratch. It’s an indispensable tool for clarity and preventing future misunderstandings.

Whether you are launching a single-member LLC or a multi-member entity, an operating agreement provides a solid foundation for your business. It outlines the responsibilities and rights of each member, clarifies the ownership structure, and establishes clear procedures for various operational aspects. Think of it as the ultimate guidebook for your Maryland LLC, offering structure and security right from the start.

Why Your Maryland LLC Absolutely Needs an Operating Agreement

Even though Maryland state law does not legally require you to file an operating agreement with any government agency, its importance cannot be overstated. It acts as the internal constitution for your LLC, dictating the rules of engagement for all members and establishing the framework for day-to-day operations and major decisions. Without one, your business might be governed by default state statutes, which may not align with your specific intentions or unique business structure.

For multi-member LLCs, an operating agreement is particularly critical. It provides a clear roadmap for how members interact, contribute capital, share profits, and handle potential disputes. Imagine trying to run a business with multiple partners without a clear understanding of who does what, how much everyone owns, or what happens if someone wants to leave. This document prevents internal conflict and ensures that all members are on the same page regarding their roles and expectations.

Even single-member LLCs benefit significantly from having an operating agreement. While you might be the sole decision-maker, this document is essential for maintaining the corporate veil. It helps to distinguish your personal assets from your business assets, bolstering your limited liability protection in the event of legal challenges or creditors. Proving your LLC is a separate legal entity is easier when you have formal documentation outlining its structure and operations.

Beyond internal governance, an operating agreement offers clarity regarding important business decisions, such as how new members are admitted, what happens if a member passes away or becomes incapacitated, or the process for dissolving the company. It provides a formal record of these agreements, which can be invaluable years down the line. Moreover, many financial institutions will request to see your operating agreement when you try to open a business bank account or apply for business loans, making it a practical necessity for financial operations.

In essence, an operating agreement protects your investment, defines relationships, and creates a stable environment for your LLC to thrive. It’s a proactive step that can save you significant time, money, and headaches in the long run by clearly setting out the parameters for your business.

Key Elements to Include in Your Agreement

To ensure your operating agreement is comprehensive and effective, consider incorporating the following crucial provisions:

- Member Contributions and Ownership Percentages: Clearly define how much each member has contributed in terms of capital, assets, or services, and their corresponding ownership stake.

- Management Structure: Specify whether your LLC will be member-managed (all members participate in management) or manager-managed (a designated manager or group of managers oversees daily operations).

- Voting Rights and Decision-Making Processes: Outline how major decisions will be made, including voting thresholds and procedures for meetings.

- Profit and Loss Distributions: Detail how profits and losses will be allocated among members, typically based on ownership percentages.

- Procedures for Adding or Removing Members: Establish clear rules for admitting new members, or for handling a member’s departure, whether voluntary or involuntary.

- Dissolution Procedures: Define the steps and conditions under which the LLC might be dissolved, and how its assets would be distributed.

- Buyout Provisions: Include clauses addressing what happens if a member wants to sell their interest, including valuation methods and rights of first refusal for existing members.

Choosing the Right Maryland LLC Operating Agreement Template

While the idea of drafting an operating agreement from scratch can seem daunting, there are numerous resources available, including specific templates designed to simplify the process. When seeking a maryland llc operating agreement template, it is important to find one that is comprehensive and tailored to your needs. Generic templates might provide a starting point, but a template specifically designed with Maryland’s legal landscape in mind can offer a better fit and ensure compliance with any state-specific nuances.

A good template should be easy to understand and customize, allowing you to fill in the unique details of your LLC, such as member names, capital contributions, and management preferences. Look for templates that include all the essential provisions discussed earlier, and perhaps even offer different versions for single-member versus multi-member LLCs. The goal is to find a template that guides you through the process, prompting you to consider all important aspects of your business operations and member relationships.

While a template is an excellent starting point and can save significant legal fees, it is always a wise decision to have a legal professional review your completed operating agreement. This is especially true for complex LLC structures or if you anticipate intricate member relationships. An attorney can ensure that the document accurately reflects your intentions, complies with all relevant Maryland laws, and provides the maximum possible protection for your business and its members.

Developing a robust operating agreement is one of the most proactive and beneficial steps you can take for your Maryland LLC. It protects your business and its members by clearly defining roles, responsibilities, and operational procedures, minimizing the potential for future disputes. By taking the time to create this foundational document, you are building a clear and secure framework for your company’s long-term success.