Navigating the waters of real estate in Maine can be an exciting journey, whether you’re dreaming of a coastal retreat, a lakeside cabin, or a bustling city home. The process of buying or selling property involves many steps, and at the heart of every successful transaction lies a well-crafted agreement that clearly outlines the terms and conditions for both parties. This document serves as the binding contract, ensuring clarity and protection for everyone involved in what is often one of life’s biggest financial decisions.

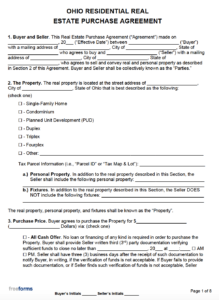

Understanding the intricacies of such an agreement is paramount. That’s why many people seek out a reliable maine purchase and sale agreement template. This crucial document acts as the blueprint for your real estate deal, formalizing everything from the agreed-upon price to the timeline for closing, and detailing the responsibilities of the buyer and seller. Having access to a comprehensive template can provide a solid foundation, giving you peace of mind as you move forward.

This article aims to demystify the Maine purchase and sale agreement, guiding you through its essential components and explaining why a robust template is invaluable. We’ll explore what makes these agreements so important, how to effectively use and customize them, and what key considerations you should keep in mind to ensure a smooth and successful property transfer.

Understanding the Maine Purchase and Sale Agreement

At its core, a Maine Purchase and Sale Agreement is a legally binding contract that outlines the specific terms and conditions under which a buyer agrees to purchase real estate from a seller in the state of Maine. It’s much more than just a simple offer; it’s a comprehensive document that covers all the critical details of the transaction. From the moment both parties sign it, the agreement sets the stage for the entire closing process, dictating timelines, responsibilities, and contingencies. Without this foundational document, the complex process of transferring property ownership would be chaotic and fraught with uncertainty.

The importance of using a clear, well-structured template cannot be overstated. While every transaction has its unique nuances, a good template provides a standardized framework that ensures all necessary legal and practical points are addressed. It helps prevent misunderstandings by explicitly stating what each party expects and commits to, covering everything from financing details to the condition of the property. This clarity minimizes potential disputes down the line, saving both time and money for everyone involved.

Every robust Maine Purchase and Sale Agreement template will contain several key components designed to protect both the buyer and the seller. These sections work together to create a comprehensive picture of the deal, leaving little to chance. Getting familiar with these elements will empower you to understand the agreement fully and negotiate confidently.

Key Components You’ll Find

- Buyer and Seller Information: Full legal names and contact details of all parties involved.

- Property Description: A precise legal description of the property being sold, often including the street address, lot number, and sometimes a reference to a recorded plan.

- Purchase Price and Payment Terms: The agreed-upon sale price and how the buyer intends to pay, including any financing details.

- Earnest Money Deposit: Details about the deposit made by the buyer to demonstrate serious intent, including the amount and how it will be held.

- Contingencies: Conditions that must be met for the sale to proceed, such as successful financing approval or a satisfactory home inspection.

- Closing Date and Location: The target date and place for the final transfer of ownership.

- Inclusions and Exclusions: A list of items that are included in the sale (like appliances, fixtures) or specifically excluded.

- Default Provisions: What happens if either the buyer or seller fails to uphold their end of the agreement.

Contingencies are particularly critical in a purchase and sale agreement. They provide an “out” for either party if certain conditions aren’t met, acting as vital safeguards. For example, a home inspection contingency allows the buyer to back out or renegotiate if significant defects are discovered. Similarly, a financing contingency protects the buyer if they are unable to secure a loan. Understanding these clauses is essential, as they define the circumstances under which the agreement can be terminated without penalty.

Even with a well-designed template, it’s wise to consider professional legal advice. While a template provides an excellent starting point, an attorney specializing in Maine real estate can review the specific terms, add unique clauses relevant to your situation, and ensure that your interests are fully protected. This expert guidance can be invaluable, especially when dealing with complex properties or unusual transaction terms.

How to Use and Customize Your Maine Purchase and Sale Agreement Template

Using a Maine Purchase and Sale Agreement template effectively means more than just filling in the blanks; it involves careful consideration and customization to fit the unique circumstances of your transaction. While templates provide a standardized structure, every property sale or purchase has its own specific details, from the type of financing to the condition of the home and any special requests from either party. Taking the time to personalize the document ensures that it accurately reflects the agreement reached between the buyer and seller.

Start by thoroughly reviewing each section of the template. Don’t rush through it. Understand what each clause means and how it applies to your situation. Then, systematically fill in all the specific details. This includes accurate property descriptions, the precise purchase price, the earnest money deposit amount, the proposed closing date, and any specific items that are to be included or excluded from the sale. Precision here is key, as any ambiguity could lead to future disputes.

It’s also important to consider adding any necessary addendums or specific clauses that address unique aspects of your deal. For instance, if there are unusual repairs to be made before closing, or if the sale is contingent on the buyer selling their current home, these specific conditions should be clearly documented in an addendum referenced within the main agreement.

- Review all sections thoroughly, understanding the implications of each clause.

- Fill in specific details accurately, ensuring no blanks are left that could create ambiguity.

- Consider adding addendums for unique situations, such as specific repair agreements or sale contingencies.

- Ensure all dates and deadlines are clearly stated, including inspection periods and closing dates.

- Seek legal advice to review the customized agreement before it is signed by all parties.

Remember that a template is a starting point, not a one-size-fits-all solution. It needs to be dynamic enough to accommodate the specifics of your real estate transaction. Consulting with a real estate professional or an attorney in Maine during the customization process can provide invaluable insights and ensure that your final agreement is legally sound and fully protects your interests.

Entering into a real estate transaction is a significant moment for both buyers and sellers. A well-prepared and thoroughly understood purchase and sale agreement is the cornerstone of a successful deal, providing clarity, legal protection, and a clear roadmap for the entire process. Taking the time to craft this document with care, ideally starting with a robust template and customizing it to your specific needs, sets the stage for a smooth and satisfying experience.

Ultimately, your goal is to ensure that all parties clearly understand their rights and responsibilities, leaving no room for misunderstanding as you move towards closing. By diligently preparing this critical agreement, you can approach your real estate transaction with confidence, knowing that you have a solid foundation for a positive outcome.