Buying a home is often the biggest financial decision many of us will ever make. It’s a huge step, and sometimes, taking that step with another person, whether it’s a romantic partner, a family member, or even a close friend, just makes sense. Shared ownership can lighten the financial burden, pool resources, and make homeownership a reality sooner. However, just like any shared venture, it comes with its own set of potential challenges and misunderstandings if expectations aren’t clearly laid out from the start.

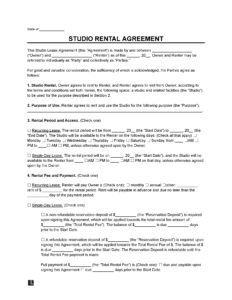

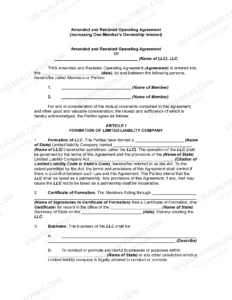

That’s where a well-crafted house co ownership agreement template becomes invaluable. This isn’t just a piece of paper; it’s a living document that outlines the rights, responsibilities, and expectations of each owner. It serves as a roadmap for your co-ownership journey, helping to prevent disputes before they even arise, and providing a clear framework for resolving them if they do. Think of it as insurance for your relationship and your investment.

Without a formal agreement, you’re essentially leaving critical aspects of your shared property to chance, or worse, to potentially uncomfortable conversations down the line. Defining terms upfront ensures everyone is on the same page regarding finances, maintenance, decision-making, and potential exit strategies, giving all parties peace of mind and protecting your valuable investment.

Why You Absolutely Need a Co-Ownership Agreement

Imagine a scenario where you and a co-owner have different ideas about who pays for an unexpected roof repair, or what happens if one of you wants to sell while the other doesn’t. Without a clear agreement, these situations can quickly escalate from minor disagreements into major conflicts, potentially damaging relationships and putting your shared asset at risk. A co-ownership agreement is designed to foresee these common challenges and provide a pre-agreed solution, saving you stress and potential legal fees.

This document acts as your guiding star, detailing how you’ll manage your property together, both financially and practically. It legally protects all parties involved, ensuring that everyone’s contributions and expectations are acknowledged and respected. It’s about building a solid foundation for your shared property venture, making sure that what seems obvious to one person is also clear and agreed upon by the other.

Shared homeownership is growing in popularity, whether it’s two friends purchasing their first starter home, siblings inheriting a family property, or unmarried partners pooling resources to afford a larger place. Each unique situation brings its own dynamics, but the underlying need for clarity remains constant. An agreement ensures that the excitement of buying a home together isn’t overshadowed by future uncertainties.

Key Areas Your Agreement Should Cover

When drafting your agreement, there are several crucial aspects you’ll want to address thoroughly. Thinking through these points now will prevent many headaches later.

Here are some of the most important elements to include:

- Ownership Shares: Clearly define what percentage of the property each co-owner owns. This might be equal, or it might reflect different financial contributions to the down payment or mortgage.

- Financial Contributions: Detail who is responsible for what expenses. This includes the initial down payment, monthly mortgage payments, property taxes, insurance premiums, utilities, and anticipated repair and maintenance costs.

- Decision-Making Process: Establish how major decisions will be made. Will it be unanimous consent, a majority vote, or does one owner have veto power over certain issues? Think about renovations, refinancing, or selling the property.

- Exit Strategy: Outline the process if one owner wants to sell their share or if the entire property is to be sold. What happens if one owner wants to buy out the other? What is the valuation process?

- Dispute Resolution: Plan for the unfortunate possibility of disagreements. Will you first try mediation, arbitration, or will you go directly to legal action? Having a pathway helps avoid prolonged conflict.

- Maintenance and Repairs: Define who is responsible for day-to-day upkeep and how major repairs will be financed and decided upon.

- Guests and Occupancy Rules: Especially relevant for co-owners who aren’t in a romantic relationship, defining rules around long-term guests or renting out portions of the property can prevent friction.

Crafting Your Agreement: DIY or Professional Help?

When it comes to putting together your house co ownership agreement template, you have a couple of routes you can take. You might find plenty of generic templates online that offer a good starting point, allowing you to fill in the blanks with your specific terms. This can be a cost-effective way to get the basic framework down, especially if your co-ownership situation is relatively straightforward and all parties are in strong agreement. It empowers you to tailor the document to your unique needs without immediate legal expense.

However, it’s important to remember that while a template provides a solid foundation, every co-ownership scenario is unique. A generic template might not cover all the specific nuances of your personal or financial arrangement. Using one as a guide to prompt discussions and define your terms is excellent, but ensure you’ve thought deeply about all potential “what ifs” that are relevant to your particular circumstances.

For more complex situations, or simply for added peace of mind, consulting with a real estate attorney is highly recommended. A lawyer can review your draft agreement, highlight potential pitfalls you might have overlooked, and ensure that the document is legally sound and enforceable in your jurisdiction. They can offer invaluable advice tailored to your situation, making sure your agreement truly protects everyone involved and aligns with local laws.

Entering into co-ownership is a significant commitment that comes with both wonderful opportunities and potential challenges. By proactively addressing key areas through a comprehensive agreement, you are not only safeguarding your financial investment but also fortifying the relationship you share with your co-owner. This thoughtful preparation sets the stage for a harmonious and successful co-ownership experience, allowing you to focus on the joys of shared homeownership.

Taking the time to draft a clear, fair, and legally sound co-ownership agreement is one of the smartest moves you can make. It demonstrates foresight, respect for all parties, and a commitment to a smooth partnership. Protect your home, your finances, and your relationships by ensuring all the terms of your shared property are defined and agreed upon before any issues have a chance to arise.