When you’re embarking on a significant transaction, whether it’s buying a home, securing a high-value item, or even entering into a complex service agreement, there’s often a stage where one party wants to show they’re serious. This isn’t just about putting down a portion of the payment; it’s about demonstrating genuine intent and commitment to the deal moving forward. It’s a handshake, but with a bit more weight to it, signaling that both sides are ready to proceed in earnest.

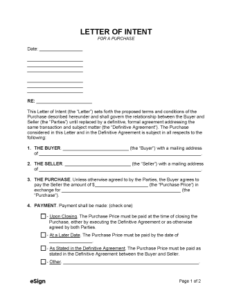

This is precisely where the concept of a good faith deposit comes into play. It’s a sum of money provided by one party to another to indicate their serious intention to fulfill the terms of an upcoming contract. To ensure this process is smooth, transparent, and protects both parties, having a clear good faith deposit agreement template becomes indispensable. This document lays out the rules of engagement, specifying what the deposit is for, under what conditions it might be returned, and when it might be forfeited.

Without a properly drafted agreement, what begins as a simple show of commitment can quickly devolve into misunderstandings and potential disputes. Clarity from the outset prevents headaches down the line, ensuring that both the giver and receiver of the deposit understand their rights and obligations. It fosters trust and provides a solid foundation for the larger transaction to proceed without unnecessary hiccups.

Understanding the Core of a Good Faith Deposit

At its heart, a good faith deposit is an expression of commitment. It’s a signal from a potential buyer or client that they are genuinely interested in moving forward with a deal and are willing to put a monetary stake on that interest. Unlike a down payment, which typically goes towards the final purchase price, or a security deposit, which protects against damages or non-performance, a good faith deposit’s primary purpose is often to reserve an item or service for a short period while further negotiations or due diligence take place. It essentially takes the item off the market, giving the serious party time to finalize their arrangements.

Imagine you’re interested in a unique vintage car. You might offer a good faith deposit to the seller to ensure they don’t sell it to someone else while you arrange financing or get an independent mechanic to inspect it. The deposit isn’t part of the car’s price yet; it’s a commitment fee that holds your place in line. The terms governing this kind of deposit are crucial because they dictate when and if that money will be returned or applied to the final sale.

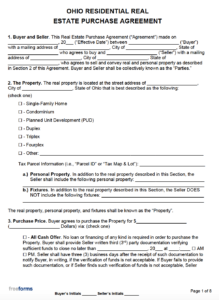

This type of deposit is incredibly common in industries like real estate, where a buyer might place a good faith deposit on a property to demonstrate their serious intent to purchase while they secure mortgage approval and conduct inspections. It assures the seller that the buyer isn’t just window shopping and that their time and effort in taking the property off the market won’t be in vain. Having a robust agreement ensures everyone is on the same page regarding the timelines and conditions involved.

Key Elements Your Template Should Cover

A well-structured good faith deposit agreement needs to be comprehensive to protect both parties. It’s not enough to just state the amount; you need to clearly define the parameters of the agreement. Overlooking even a single detail can lead to significant complications later on.

Here are some essential components that every good faith deposit agreement template should include:

- **Identification of Parties:** Full legal names and contact information for both the party making the deposit and the party receiving it.

- **Deposit Amount:** The exact monetary sum being tendered as a good faith deposit.

- **Purpose of Deposit:** A clear statement outlining what the deposit is for (e.g., reserving a specific property, holding a product, securing a service contract).

- **Conditions for Refund:** Explicitly detail the circumstances under which the deposit will be fully or partially returned to the depositor (e.g., failure of financing, unsatisfactory inspection results, seller backing out).

- **Conditions for Forfeiture:** Clearly define when the deposit will be kept by the recipient (e.g., buyer backing out without a valid reason, failure to meet agreed-upon deadlines).

- **Timeline:** Specify any relevant dates, such as the period for which the deposit holds the item or service, deadlines for inspections, or when a final contract must be signed.

- **Application of Deposit:** State whether the deposit will be applied towards the final purchase price, refunded, or forfeited upon completion or termination of the underlying agreement.

- **Governing Law and Dispute Resolution:** Which jurisdiction’s laws will apply and how any disagreements will be handled (e.g., mediation, arbitration).

- **Signatures:** Signatures of all involved parties, indicating their agreement to the terms, along with the date.

Each of these elements must be articulated with precision. Vague language can be misinterpreted and exploited, leading to costly legal battles. For instance, simply stating "deposit will be refunded if the deal doesn’t go through" is insufficient. It needs to specify why the deal didn’t go through and whose responsibility that was.

Ultimately, the goal is to create a document that leaves no room for ambiguity. This provides a clear roadmap for both parties, fostering a smoother transaction and minimizing potential friction points. It’s a foundational step towards building a successful business relationship based on trust and mutual understanding.

Navigating Common Pitfalls and Ensuring Protection

Even with a template, it’s easy to fall into common traps if you’re not meticulous with the details. One of the biggest pitfalls is assuming mutual understanding without explicitly writing it down. What seems obvious to one party might be a complete blind spot for another. For instance, a buyer might assume their good faith deposit is fully refundable if they change their mind, while the seller might assume it’s theirs to keep if the buyer walks away for any reason. These mismatched expectations are fertile ground for disputes.

Another common issue arises when the conditions for refund or forfeiture are too broad or lack specific triggers. Vague phrases like "reasonable time" or "material breach" can be subjective and open to interpretation. Instead, specify concrete deadlines, define what constitutes a "material breach" in the context of your agreement, and list all potential scenarios where the deposit might change hands. Precision in language is your strongest ally against future disagreements.

Protecting yourself means being proactive. Don’t hesitate to seek legal advice if the transaction is complex or involves a substantial sum of money. A legal professional can review your good faith deposit agreement template and tailor it to your specific situation, ensuring it complies with local laws and provides robust protection. It’s an investment that can save you significant time, money, and stress down the road.

A thoughtfully constructed good faith deposit agreement is more than just a formality; it’s a vital tool for establishing clear expectations and safeguarding your interests in any transaction. It acts as a bridge of trust between parties, ensuring that everyone involved understands their commitment and the consequences of their actions.

By meticulously outlining the terms, conditions, and eventual disposition of the deposit, you create a solid foundation for any subsequent agreements. This clarity fosters confidence, allowing both sides to proceed with their larger transaction knowing that the preliminary steps have been handled with care and transparency, paving the way for a successful outcome.