Navigating the financial landscape of a medical practice can be intricate, often presenting challenges for both patients and administrative staff. From understanding insurance benefits to managing deductibles and co-pays, a lack of clarity can lead to confusion, frustration, and even unpaid bills. It’s a delicate balance to ensure patients receive the care they need while maintaining the financial health of your office.

This is precisely why having a robust financial agreement template for medical office use is not just a good idea, but an essential component of efficient practice management. It acts as a transparent guide, setting clear expectations from the outset and fostering a relationship of trust between your practice and your patients. By outlining responsibilities and procedures upfront, many potential misunderstandings can be gracefully avoided.

In the following sections, we’ll delve into the significant advantages of implementing a well-crafted financial agreement, explore the key components it should contain, and discuss best practices for introducing it to your patients. This proactive approach ensures smoother operations, reduces administrative burden, and helps patients feel more secure about their healthcare journey.

Why Your Medical Office Needs a Solid Financial Agreement

Imagine a scenario where every patient fully understands their financial responsibilities before any service is rendered. This isn’t just a dream; it’s the reality a comprehensive financial agreement can create. One of the primary benefits is the prevention of misunderstandings. When patients sign a document detailing what they owe, when they owe it, and what happens if payments are missed, there’s little room for misinterpretation. This clarity builds trust and reduces the likelihood of awkward conversations later on, fostering a more positive patient experience overall.

Furthermore, a well-defined agreement helps to clarify the often-complex interplay between insurance providers and patient responsibility. It meticulously outlines what services are typically covered by insurance, what constitutes a patient’s co-pay or deductible, and what services might be considered out-of-pocket expenses. This is particularly important in today’s healthcare environment where plans vary widely, and patients might not always be fully aware of their specific benefits.

Beyond clarity, these agreements serve as a crucial tool for financial stability within your practice. By establishing payment terms upfront, including policies for late payments or payment plans, you create a predictable revenue stream. This proactive approach significantly reduces the number of overdue accounts and minimizes the resources spent on collections, allowing your team to focus more on patient care and less on chasing payments.

Another powerful aspect of a strong financial agreement is the legal protection it offers. In the unfortunate event of a payment dispute, a signed document provides concrete evidence of the agreed-upon terms. It demonstrates your practice’s commitment to transparency and fairness, which can be invaluable in resolving conflicts swiftly and equitably, safeguarding your practice from potential legal challenges.

Finally, integrating such a template into your patient intake process streamlines administrative tasks. It standardizes how financial information is communicated and documented, ensuring consistency across all patient interactions. This efficiency frees up your staff from repetitive explanations and allows them to dedicate more time to critical operational duties, enhancing the overall productivity of your medical office.

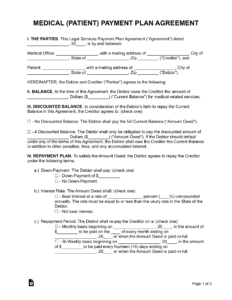

Essential Elements to Include in Your Agreement

- Patient’s full name and contact information

- Clinic’s name and contact information

- Clear statement of financial responsibility, including co-pays, deductibles, and co-insurance

- Explanation of billing practices and statement cycles

- Policy regarding payment for non-covered services or services deemed not medically necessary by insurance

- Details on payment options (e.g., credit card on file, payment plans)

- Policy for late payments, missed appointments, or cancellations

- Information about collections processes, if applicable

- Disclaimer regarding insurance estimates versus actual payment responsibilities

- Patient signature and date acknowledging understanding and agreement

Implementing and Communicating Your Financial Policies Effectively

Having an excellent financial agreement template for medical office use is only half the battle; the other half is effectively implementing and communicating it to your patients. The key is to introduce the agreement early in the patient journey, ideally during the initial registration process. This gives patients ample time to review the document, ask questions, and fully understand their obligations before receiving any services. It’s vital that staff members are well-versed in the agreement’s contents and can patiently explain any clauses that might be unclear to patients.

When presenting the agreement, adopt a compassionate yet firm approach. Frame it not as a demand, but as a tool designed for transparency and to prevent future financial surprises for the patient. Encourage questions and provide a comfortable environment for discussion. Offering a quiet space for patients to read through the document and ensuring a staff member is available to answer queries without rushing them can significantly improve patient acceptance and understanding. A good practice is to provide a copy of the signed agreement to the patient for their records.

Regularly reviewing and updating your financial agreement is also crucial. Healthcare regulations, insurance policies, and your practice’s operational needs can change over time. By conducting an annual review, you ensure that your agreement remains current, compliant, and reflective of your current policies. Any updates should be communicated clearly to existing patients and integrated seamlessly into the onboarding process for new ones, maintaining consistency and clarity across your entire patient base.

By clearly outlining expectations from the beginning, a well-crafted financial agreement empowers patients to make informed decisions about their care and manage their healthcare costs effectively. It transforms potential financial friction into a smooth, predictable process, bolstering the patient-provider relationship and allowing your team to concentrate on delivering outstanding medical care.

Ultimately, integrating a comprehensive financial agreement is a strategic move that pays dividends in both patient satisfaction and operational efficiency. It provides a solid foundation for financial transparency, reduces administrative burdens, and protects your practice, creating a more harmonious and financially sound environment for everyone involved.