Navigating the world of commercial finance can often feel like a complex journey, whether you are a business owner seeking capital or a financial expert connecting businesses with the right funding. In this intricate landscape, clarity and mutual understanding are paramount to ensure smooth transactions and successful partnerships. Agreements that clearly define roles, responsibilities, and compensation are not just good practice, they are essential.

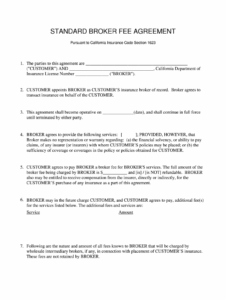

This is precisely where a solid commercial loan broker fee agreement template becomes an invaluable asset. It serves as a foundational document, laying out the terms and conditions between a commercial loan broker and their client. Having such a template readily available ensures that all parties are on the same page regarding the services provided, the fees incurred, and the expectations for the entire engagement, ultimately protecting everyone involved.

By understanding the key components of such an agreement and knowing how to effectively tailor it to various situations, both brokers and businesses can avoid misunderstandings, mitigate risks, and build trust. Let us delve into what makes these agreements so crucial and how you can best utilize them to foster transparent and efficient commercial lending relationships.

Understanding the Essentials of a Commercial Loan Broker Fee Agreement

A commercial loan broker fee agreement is more than just a piece of paper; it is a binding contract that formalizes the working relationship between a business seeking a commercial loan and the broker facilitating that loan. At its core, this document outlines the scope of services the broker will provide, the fee structure for those services, and the conditions under which those fees become payable. It is designed to bring professionalism and legal protection to a relationship that involves significant financial stakes.

For businesses, having a clear agreement means you know exactly what to expect from your broker, preventing any surprise charges or unexpected obligations. For brokers, it solidifies your right to compensation for the specialized expertise and connections you bring to the table. Without such an agreement, either party could face ambiguity, leading to disputes, delays, and potential financial losses, which nobody wants in the fast-paced world of commercial financing.

The true power of a well-drafted agreement lies in its ability to preemptively address potential friction points. By clearly delineating responsibilities and payment terms upfront, both parties can focus on the primary goal: securing the best possible commercial loan for the business. This clarity fosters a collaborative environment, enhancing the likelihood of a successful outcome for everyone involved.

Key Components to Include

When you look at a commercial loan broker fee agreement template, you will notice several critical sections designed to cover all the bases. Each part plays a vital role in creating a comprehensive and legally sound document.

* Party Identification: Clearly names and identifies the commercial loan broker and the client, including their legal business names and addresses.

* Scope of Services: This section details the specific tasks the broker will undertake, such as identifying potential lenders, assisting with loan applications, negotiating terms, and generally guiding the client through the financing process.

* Fee Structure: Perhaps the most crucial part, this explains how the broker will be compensated. It might be a percentage of the loan amount, a flat fee, an hourly rate, or a success fee contingent on the loan closing. Transparency here is absolutely non-negotiable.

* Payment Terms: Specifies when the fees are due. Is it upon signing the agreement, upon loan approval, or upon the final closing and funding of the loan? Are there any retainer fees involved?

* Exclusivity: Many agreements include a clause stating whether the broker is the exclusive agent for a certain period, meaning the client cannot engage other brokers for the same loan during that time.

* Term and Termination: Defines the duration of the agreement and the conditions under which either party can terminate it prematurely, including any associated penalties or obligations.

* Confidentiality: Protects sensitive financial and business information shared between the parties during the loan acquisition process.

* Indemnification: A clause designed to protect one party from liability for actions or omissions of the other party.

* Governing Law: Specifies which state’s laws will govern the interpretation and enforcement of the agreement.

Each of these components is essential for constructing a robust agreement that protects the interests of both the broker and the client. Overlooking any one of them can create gaps that lead to future complications.

Tailoring Your Template for Success

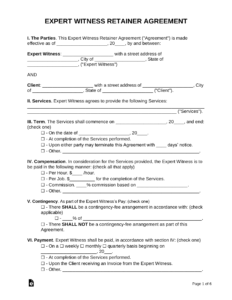

While a generic commercial loan broker fee agreement template provides an excellent starting point, real success comes from tailoring that template to fit the unique circumstances of each deal. No two commercial loan transactions are exactly alike; the type of loan, the client’s financial situation, the complexity of the deal, and the specific services a broker will provide can all vary significantly. Therefore, a “one size fits all” approach rarely yields the best results and can even lead to misunderstandings down the line.

Consider the different types of commercial financing available, such as SBA loans, conventional real estate loans, equipment financing, or working capital lines. Each might necessitate different clauses or fee structures within the agreement. For instance, a complex real estate development loan might require more extensive due diligence and negotiation services from the broker, which should be reflected in the scope of work and potential compensation. Conversely, a straightforward equipment lease might warrant a simpler, more streamlined agreement.

The process of customizing your agreement is also an opportunity to build trust and demonstrate your professionalism. When discussing and modifying a commercial loan broker fee agreement template, open communication between the broker and client is key. This ensures that both parties clearly understand the personalized terms, feel comfortable with the commitments, and are confident that the agreement accurately reflects the agreed-upon services and compensation. A well-tailored document helps foster a strong, transparent relationship from the outset, paving the way for a smoother and more successful financing journey.

A carefully crafted and mutually understood agreement stands as a testament to professionalism and foresight in the commercial lending arena. It lays down a transparent framework that guides all interactions, clarifies expectations, and provides a clear path forward for both brokers and their clients. Such diligence not only safeguards against potential disagreements but also enhances the efficiency and effectiveness of the entire loan acquisition process.

Ultimately, by embracing the power of detailed and customized agreements, all parties involved in commercial financing can proceed with confidence. This strategic approach ensures that valuable resources are focused on achieving the desired financial outcomes, free from the distractions of contractual ambiguities, and allows for the building of stronger, more reliable business relationships in the long run.