Embarking on the journey of buying or selling a business can be an exciting yet complex venture. Whether you are acquiring a thriving enterprise or divesting a successful part of your own, the process involves intricate negotiations, due diligence, and, critically, legally sound documentation. Getting the paperwork right is paramount to ensure a smooth transition and protect all parties involved, setting the stage for future success.

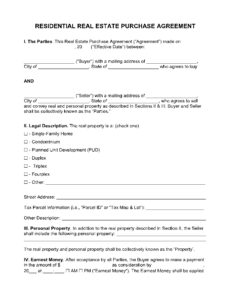

One of the most vital documents in this entire process, especially when you are only interested in specific components of a business rather than the entire corporate entity, is the asset purchase agreement. This comprehensive legal instrument lays out all the terms and conditions of the sale of a business’s assets. Having a reliable business asset purchase agreement template can be incredibly helpful in navigating these detailed transactions efficiently.

A well-crafted template acts as a foundational roadmap, guiding you through the essential clauses and considerations necessary for a secure transaction. It helps both buyers and sellers understand their rights and obligations, ensuring transparency and minimizing potential disputes down the line. It’s not just a formality; it’s a strategic tool for a successful acquisition or divestiture.

What Exactly is an Asset Purchase Agreement?

An asset purchase agreement is a contract between a buyer and a seller for the sale of a business’s assets. Unlike a stock purchase, where the buyer acquires shares in the selling company and effectively takes on the entire entity, an asset purchase allows the buyer to selectively acquire specific assets and assume only explicitly defined liabilities. This distinction is crucial and significantly impacts aspects like tax implications, liability exposure, and the scope of what is actually being transferred.

From the buyer’s perspective, choosing an asset purchase often boils down to managing risk and control. By purchasing only assets, the buyer can “cherry-pick” what they want—equipment, intellectual property, inventory, customer lists, specific contracts, or goodwill—while potentially avoiding the historical liabilities of the selling entity, such as past litigation, environmental issues, or undisclosed debts. This gives the buyer a cleaner slate to build upon.

For the seller, an asset purchase can offer different advantages, particularly concerning tax treatment or the desire to retain the corporate shell for future endeavors, even after selling off its operational components. It allows the seller to strategically divest parts of their business without dissolving the entire legal entity, offering flexibility in their long-term business strategy.

This type of agreement outlines everything from the specific assets being transferred to the purchase price, payment terms, and various representations and warranties made by both parties. It also addresses how employees, contracts, and permits will be handled, which are often significant points of negotiation. Without a detailed agreement, misunderstandings could easily arise, leading to costly legal battles.

Think of it as the blueprint for transferring the operational heart of a business, piece by piece. Every item, every value, every condition is meticulously detailed to ensure there are no ambiguities. It requires careful consideration of what is included, what is excluded, and what protections are in place for both the buyer and the seller throughout and after the transaction.

Key Components of Your Agreement

When reviewing or customizing a business asset purchase agreement template, you’ll typically encounter several critical sections that need careful attention and customization. These include:

- Identification of Assets: A precise list or clear description of all assets being purchased, which can range from physical property to intangible assets like trademarks and customer relationships.

- Purchase Price and Payment Terms: How much is being paid, when, and in what form (e.g., lump sum, installments, earn-outs).

- Representations and Warranties: Statements of fact made by both the buyer and seller regarding their business, assets, and authority to enter the agreement. These are crucial for recourse if something proves untrue.

- Covenants: Promises made by both parties to do or not do certain things before and after the closing date (e.g., seller will not compete for a certain period, buyer will honor existing customer contracts).

- Conditions to Closing: Events or actions that must occur before the transaction can be finalized (e.g., regulatory approvals, successful completion of due diligence).

- Indemnification: Clauses that protect one party from financial loss or damages caused by the other party’s breach of contract, misrepresentation, or specific pre-closing liabilities.

Navigating the Template: Essential Considerations

While a business asset purchase agreement template provides a solid starting point, it’s vital to remember that every business transaction is unique. The template is a framework, not a one-size-fits-all solution. Customization is not just recommended; it’s absolutely necessary to ensure the agreement accurately reflects the specific terms negotiated between the buyer and seller, and addresses the unique characteristics of the assets and liabilities involved. Ignoring this customization step can lead to significant problems down the line.

Key areas demanding careful attention include the detailed schedule of assets being transferred, the allocation of the purchase price among those assets (which has important tax implications for both parties), and the specific representations, warranties, and indemnities tailored to the risks identified during due diligence. For instance, if the business relies heavily on intellectual property, the IP clauses will need to be particularly robust. Similarly, if there are ongoing contracts or employee transitions, these sections will require meticulous drafting.

Additionally, consider elements such as bulk sales laws, the assumption of contracts and leases, and how customer data or trade secrets will be managed post-acquisition. Due diligence should inform every single modification to the template, highlighting potential liabilities or areas of concern that require specific contractual protection. A template can’t anticipate every nuance of a particular business sale, so an active and engaged approach to customization is crucial.

Ultimately, even with an excellent business asset purchase agreement template, legal expertise is indispensable. Engaging an experienced attorney ensures that the agreement is not only legally sound and enforceable but also effectively protects your interests. They can help you navigate complex legal language, identify potential pitfalls, and negotiate terms that are most favorable to your position, safeguarding your investment or your legacy in the transaction.

Careful planning and the right legal documentation are the bedrock of any successful business acquisition or sale. Utilizing a robust agreement template, customized with expert legal guidance, ensures that all aspects of the deal are clearly defined and legally binding. This proactive approach helps mitigate risks and paves the way for a smooth, transparent, and mutually beneficial transition for all involved parties.