Life often presents situations where financial arrangements need to be reshuffled. Perhaps a lender needs to transfer their rights to collect a debt to another party, or maybe a business is restructuring its assets. Whatever the reason, the ability to formally transfer the rights and obligations associated with a loan is a crucial aspect of modern finance and debt management. It ensures that everyone involved understands the new lay of the land.

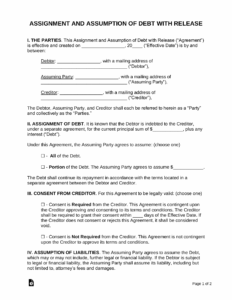

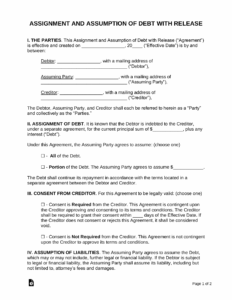

This is precisely where a well-crafted assignment of loan agreement template becomes incredibly valuable. It’s essentially a blueprint that outlines the terms under which a lender, known as the "assignor," can legally transfer their rights to receive payments and enforce the terms of an existing loan agreement to a new party, called the "assignee." Think of it as passing the baton in a relay race, but with legal precision and clarity.

Having a clear and comprehensive document is paramount. It protects all parties involved by clearly defining who owes what to whom, and under what conditions, following the transfer. Without such a formal document, disagreements and legal challenges can easily arise, making an already complex situation even more difficult to navigate.

Understanding the Mechanics of Loan Assignment

At its core, loan assignment is the legal process by which a lender (the assignor) transfers their rights and benefits from a loan agreement to another party (the assignee). This means the assignee steps into the shoes of the original lender, gaining the right to receive principal and interest payments, as well as the right to enforce any other terms or conditions of the original loan, such as pursuing collateral if there’s a default. It’s not about creating a new loan, but rather shifting ownership of an existing one.

There are numerous reasons why a lender might choose to assign a loan. For instance, a bank might sell a portfolio of loans to another financial institution to free up capital or to streamline its balance sheet. Individual lenders might need to divest themselves of a loan for personal liquidity reasons, or perhaps a business is being sold, and its outstanding receivables, including loans, are part of the asset transfer. The motivations can range from strategic business decisions to personal financial planning.

Conversely, an assignee might acquire a loan for investment purposes, seeing an opportunity to earn interest income. They might also be a collection agency specializing in debt recovery, or another financial entity looking to expand its asset base. For the borrower, it’s important to understand that while the lender changes, the fundamental terms of their original loan agreement generally remain unchanged. Their obligation to repay the loan continues, just to a new party.

Key Elements of an Assignment of Loan Agreement

A robust assignment of loan agreement template should meticulously detail several key components to ensure a smooth and legally sound transfer. It acts as a guide, helping all parties understand their rights and responsibilities throughout the transition. When you are looking for an assignment of loan agreement template, you want one that covers all bases.

Here are some essential clauses you’d expect to find:

- Identification of Parties: Clearly names the assignor, assignee, and the original borrower.

- Details of the Original Loan: Specifies the original loan agreement, including its date, principal amount, original parties, and any identifying account numbers.

- Assignment Clause: Explicitly states the assignor’s intent to assign all rights, title, and interest in the loan to the assignee.

- Consideration: Mentions any payment or value exchanged between the assignor and assignee for the assignment.

- Representations and Warranties: Statements by the assignor confirming they have the right to assign the loan and that the loan is valid and enforceable.

- Governing Law: Specifies the jurisdiction whose laws will govern the agreement.

- Notices: Outlines how formal communications related to the assignment should be delivered.

These elements work together to create a clear picture of the transfer, minimizing ambiguity and potential disputes down the line. It’s about ensuring transparency and legal enforceability for everyone involved.

Navigating the Process with Your Template

Once you have an appropriate assignment of loan agreement template, the practical steps involve tailoring it to your specific situation. This means carefully filling in all the blanks with accurate information related to the assignor, assignee, and the original loan details. Every figure, date, and name must be correct to avoid any future misunderstandings or legal challenges. It’s a precise task that demands attention to detail.

A critical aspect of any loan assignment is obtaining necessary consents and providing proper notification. In many cases, the original loan agreement itself may contain clauses dictating whether the lender can assign the loan without the borrower’s consent, or if notification is simply required after the fact. It is imperative to review the original loan document thoroughly to understand these provisions. Ignoring these steps could render the assignment invalid or lead to breaches of the original contract.

To ensure a seamless transition and adherence to legal requirements, consider these steps:

- Review the original loan agreement: Understand any restrictions or requirements for assignment.

- Customize your template: Fill in all specific details accurately, reflecting your unique situation.

- Obtain necessary consents: If required by the original agreement or law, get the borrower’s or other party’s permission.

- Execute the agreement: Have all parties sign the assignment document, often witnessed or notarized.

- Notify all relevant parties: Inform the borrower and any other interested parties about the assignment, providing details of the new lender.

Remember, while a template provides an excellent starting point, legal advice is often invaluable. A legal professional can ensure your specific assignment of loan agreement template adheres to all local laws and adequately protects your interests, whether you are the assignor or the assignee.

Transferring loan agreements can seem like a daunting task, but with a reliable assignment of loan agreement template and a clear understanding of the process, it becomes significantly more manageable. These documents are essential tools in facilitating financial transactions and ensuring that all parties’ rights and obligations are clearly defined and upheld.

Ultimately, whether you are on the giving or receiving end of a loan assignment, having a well-structured and legally sound document is your best defense against future complications. It ensures that the transfer of financial responsibility is transparent, legally enforceable, and serves the best interests of everyone involved in the transaction.