Life rarely stays static, and the financial agreements we make are no exception. Whether you’re a lender or a borrower, circumstances can change, prompting the need to modify an existing loan agreement. Perhaps a borrower faces unexpected hardship, or a lender decides to offer more flexible terms. Trying to manage these changes verbally or with informal notes can lead to serious misunderstandings and legal complications down the line. It’s crucial to formalize any alterations to protect both parties involved.

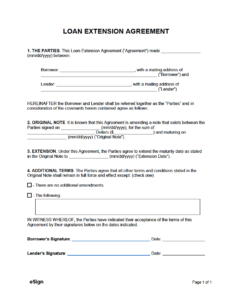

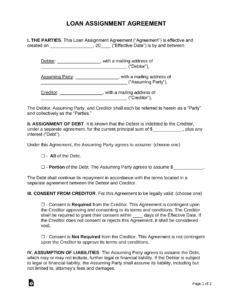

This is where a well-structured amendment comes into play. An amendment is a legally binding document that alters, adds to, or removes specific clauses from an original agreement, without invalidating the entire contract. Utilizing a solid amendment to loan agreement template can significantly simplify this process, ensuring all necessary legal components are covered and both parties are clear on the new terms. It transforms what could be a complex legal challenge into a straightforward administrative task, provided you know what to include and how to use it effectively.

Understanding the importance of such a document and how to properly draft one is key to maintaining healthy financial relationships and safeguarding your interests. This guide will walk you through the reasons you might need an amendment, the essential elements to include, and how to approach the modification process with confidence and clarity.

Why You Might Need To Amend A Loan Agreement

Financial agreements, by their nature, are designed to be stable and predictable. However, the world around us is anything but. Life throws curveballs, economic conditions shift, and personal or business situations can evolve dramatically after a loan agreement has been signed. It’s not uncommon for either the lender or the borrower to find themselves in a position where the original terms no longer make sense or have become untenable.

For lenders, amending a loan agreement might be a strategic move to help a valued borrower through a rough patch, thereby increasing the likelihood of eventual repayment rather than risking a default. It could also be a way to adjust to changing market interest rates or to secure additional collateral if the borrower’s risk profile has changed. Proactive amendments can preserve the relationship and the investment.

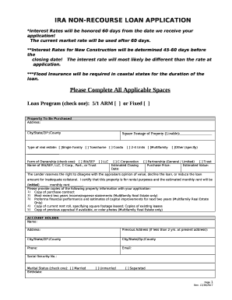

On the borrower’s side, the reasons are often driven by unforeseen financial difficulties, such as job loss, medical emergencies, or a downturn in business revenue. They might need more time to repay, a temporary reduction in payment amounts, or a modification of interest rates to make the loan affordable again. Rather than defaulting, which harms both parties, seeking an amendment offers a path to continue meeting their obligations under revised, more manageable terms.

Furthermore, amendments aren’t always about distress. Sometimes, they stem from mutual agreement to improve the terms for both sides, perhaps by consolidating multiple loans, extending the loan period for better cash flow, or even changing specific covenants within the agreement that no longer serve their original purpose. Whatever the reason, it is always better to formally document these changes to avoid future disputes and ensure legal enforceability.

Key Reasons For Modification

- Payment Schedule Changes: Adjusting the frequency or amount of installments.

- Interest Rate Adjustments: Modifying the percentage charged on the outstanding balance, often due to market shifts or renegotiation.

- Collateral Changes: Adding or substituting assets used to secure the loan.

- Loan Amount Revisions: Increasing or decreasing the principal amount of the loan.

- Covenant Modifications: Altering specific promises or restrictions agreed upon by the borrower in the original agreement.

Each of these modifications, big or small, carries significant legal weight. Ignoring the need for a formal amendment can lead to the original terms being enforced, even if both parties informally agreed otherwise, potentially causing financial hardship or legal battles.

Crafting Your Amendment: What To Include

When you’re ready to make changes to an existing loan agreement, the goal is to create a document that is clear, precise, and leaves no room for ambiguity. Think of your amendment as a precise surgical tool designed to modify only specific parts of the original contract, rather than rewriting the whole thing. It needs to stand alone as a valid legal document while also referring back to the original agreement it’s modifying.

The beauty of using an amendment to loan agreement template lies in its structured approach. It guides you through all the necessary sections, ensuring you don’t overlook critical details. Clarity is paramount; anyone reading the amendment should be able to instantly understand what was changed, what the new terms are, and how these changes interact with the original agreement. Vague language can easily lead to disputes down the line, which is exactly what you’re trying to avoid.

Every amendment, regardless of the specific changes it introduces, should contain several key elements to ensure its legal validity and effectiveness. Missing any of these could weaken the amendment’s enforceability.

- Identification of Parties: Clearly state the full legal names and addresses of both the lender and the borrower, just as they appear in the original loan agreement.

- Reference to Original Agreement: Explicitly identify the original loan agreement by its title, date of execution, and any unique identification number. This links the amendment directly to the contract it’s modifying.

- Specific Amendments: This is the core of the document. Clearly and precisely state each change being made. For example, “Paragraph 3.1 of the Original Agreement is hereby deleted in its entirety and replaced with the following…” or “A new Paragraph 5.5 shall be added to the Original Agreement, which shall read as follows…”.

- Effective Date: Specify the exact date from which the new terms outlined in the amendment will come into effect.

- Affirmation of Remaining Terms: Include a clause stating that all terms and conditions of the original loan agreement not specifically amended by this document remain in full force and effect. This prevents the amendment from unintentionally nullifying the entire original contract.

- Signatures: Both the lender and the borrower (and any guarantors, if applicable) must sign and date the amendment, preferably in the presence of witnesses or a notary public, to ensure its authenticity and legal enforceability.

By carefully detailing these components, your amendment becomes a robust legal instrument. It effectively updates your loan agreement while maintaining the integrity of the original terms that are still relevant and agreed upon.

Navigating the complexities of loan agreements and their modifications can seem daunting, but it doesn’t have to be. By understanding when and why an amendment is necessary, and by following a structured approach to drafting one, you empower yourself to manage financial relationships with precision and confidence. Always remember that clear communication and formal documentation are the cornerstones of any successful financial arrangement.

Taking the time to properly prepare and execute an amendment protects all parties involved, prevents future misunderstandings, and ensures that the financial agreement continues to serve its intended purpose even as circumstances evolve. Embrace the process with diligence, and you’ll find that adapting your agreements can be a smooth and secure path forward.