When you first set up your Limited Liability Company, one of the most crucial documents you drafted was likely your operating agreement. This foundational document outlines the internal workings of your business, detailing member rights and responsibilities, profit and loss distributions, management structure, and much more. It’s essentially the rulebook for your LLC, guiding how decisions are made and how disputes are resolved.

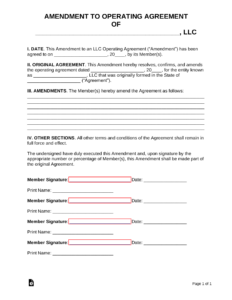

However, businesses evolve. What was true on day one might not hold true a year or five years down the line. Members might join or leave, capital contributions could change, or your management philosophy might shift. In such cases, simply creating a new agreement isn’t the most efficient or legally sound approach. This is where an amended and restated operating agreement template becomes an invaluable tool, allowing you to consolidate all changes into a single, comprehensive document.

Rather than having an original agreement plus a long trail of separate amendments, an amended and restated version offers clarity and simplifies future reference. It effectively replaces all previous iterations, making it easier for everyone involved to understand the current rules governing your LLC. It’s about ensuring your internal legal framework is as dynamic and adaptable as your business itself.

Why Your LLC Might Need an Amended and Restated Operating Agreement

Your LLC is a living entity, and just like any growing organism, its internal structure and rules may need to adapt over time. Life changes, and so do business circumstances. Maybe your initial vision for the company’s management has shifted, or perhaps you’ve realized certain clauses in the original agreement no longer serve the best interests of the members. Instead of having multiple, confusing amendments floating around, which can lead to misinterpretations and administrative headaches, a complete overhaul into a single, unified document makes practical and legal sense. This allows everyone involved to easily access and understand the most current version of their agreement.

The primary benefit of an amended and restated agreement, as opposed to just a series of amendments, is clarity. Imagine trying to navigate a legal document where you have to cross-reference the original with five different amendment documents to understand a single clause. It’s tedious and prone to error. An amended and restated version consolidates everything, making it a standalone, comprehensive agreement that supersedes all prior versions. This streamlines operations, reduces potential confusion among members, and makes it much easier to present a clear picture to third parties, like lenders or potential investors.

Consider the various reasons why an LLC might find itself needing such a significant update. These aren’t just minor tweaks but often substantial shifts in how the business operates or who is involved. Addressing these changes meticulously ensures the continued legal health and operational smoothness of your company.

Common Scenarios for Amending and Restating

Taking the time to formally amend and restate your operating agreement shows a commitment to good governance and transparency. It helps prevent future disputes by ensuring all members are operating under a clear, current, and mutually agreed-upon set of rules. Using a reliable amended and restated operating agreement template provides a solid framework to ensure all necessary modifications are properly documented and legally sound.

Key Elements to Look for in an Amended and Restated Operating Agreement Template

When you’re looking for an amended and restated operating agreement template, it’s essential to select one that is comprehensive and flexible enough to meet the specific needs of your evolving business. A good template acts as a strong foundation, but it will always require careful customization to accurately reflect your LLC’s current structure and agreements. The goal is to create a document that is both legally sound and clearly understandable to all members, preventing ambiguities that could lead to future disagreements.

The template should explicitly state that it supersedes all prior agreements and amendments, making it the definitive document governing the LLC. This is a critical legal point that ensures clarity and avoids any potential conflicts between older versions and the new, consolidated agreement. Without this clear supersedence clause, you could find yourself in a situation where different parts of the company are trying to abide by different versions of the rules.

Carefully review each section of the template to ensure it covers all the necessary provisions for your LLC. Look for sections that are easily adaptable and allow you to insert your specific details without having to rewrite entire paragraphs.

Remember, a template is a starting point, not a finished product. Always consult with legal counsel to review your customized amended and restated operating agreement. This ensures that it complies with your state’s specific LLC laws and accurately reflects the intentions and agreements of all your members, providing robust protection for your business and its stakeholders.

Navigating the complexities of an LLC’s operational changes requires careful attention to detail and a commitment to clear documentation. By consolidating all changes into a single, comprehensive amended and restated operating agreement, you provide all members with a definitive rulebook that reflects the company’s current status. This proactive approach significantly reduces the potential for misunderstandings and legal disputes down the line, fostering a more stable and transparent business environment.

Ultimately, maintaining an up-to-date and easily accessible operating agreement is a hallmark of good corporate governance. It protects the interests of all members, clarifies roles and responsibilities, and ensures that your LLC can adapt and thrive through various stages of its lifecycle. Investing the time to properly amend and restate this vital document is an investment in the long-term health and success of your business venture.