Navigating the world of accounting services can sometimes feel a bit like sailing without a map. There are expectations from both sides, deadlines to meet, and specific tasks that need to be accomplished accurately and on time. Without a clear understanding of who is responsible for what, things can quickly become confusing, leading to misunderstandings and frustration. That’s why establishing clear guidelines from the outset is incredibly beneficial for both clients and service providers.

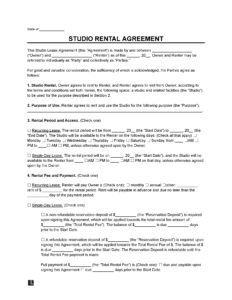

This is where a well-crafted agreement comes into play. Having a robust framework that outlines every aspect of the service relationship can make a significant difference. An accounting service level agreement template provides that crucial blueprint, ensuring everyone is on the same page regarding the scope of work, expected deliverables, response times, and even how potential issues will be resolved. It’s essentially a promise of service quality written down for all to see.

Think of it as the foundation for a successful, long-lasting partnership. It helps to prevent disputes before they even arise by clarifying roles and responsibilities, setting measurable standards, and establishing a professional baseline for the working relationship. By defining the specifics upfront, both the accounting firm and the client can focus on what truly matters: effective financial management without the constant worry of miscommunication.

What Exactly Goes Into an Accounting Service Level Agreement?

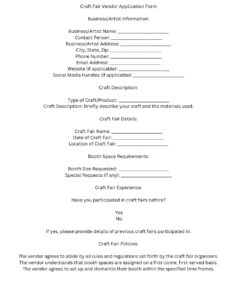

When you’re setting up an agreement for accounting services, it’s not just about listing tasks. It’s about creating a comprehensive document that leaves no room for ambiguity, ensuring both parties understand their roles and the quality of service to be delivered. This document details everything from the types of accounting services being provided to the agreed-upon standards of performance and how any issues will be addressed. It’s a living document that can be referenced throughout the engagement.

One of the first things to define is the scope of services. Are we talking about basic bookkeeping, payroll processing, tax preparation, financial reporting, or a full suite of services? Clearly outlining each specific service is paramount. This prevents either party from assuming tasks are included when they haven’t been explicitly agreed upon, avoiding potential friction down the line. It’s about being very precise about what the service provider commits to doing.

Another crucial component involves setting clear performance metrics and service standards. How quickly should a query be responded to? What’s the turnaround time for a monthly financial report? These are not just arbitrary numbers; they are measurable standards that help evaluate the quality and timeliness of the service. Without these benchmarks, it’s hard to assess if the service is meeting expectations effectively.

Key Elements to Consider in Your Accounting SLA:

- **Service Scope:** A detailed list of all accounting services to be provided.

- **Performance Metrics:** Measurable standards for service delivery, such as response times, report accuracy, and deadline adherence.

- **Roles and Responsibilities:** Clear delineation of duties for both the service provider and the client.

- **Reporting and Communication:** How and when updates will be provided, and the preferred methods of communication.

- **Problem Resolution:** A step-by-step process for handling disputes or service failures.

- **Confidentiality and Data Security:** Protocols for protecting sensitive financial information.

- **Term and Termination:** The duration of the agreement and conditions under which it can be ended.

Beyond defining the services and setting performance goals, an SLA should also cover the often-overlooked aspects like communication protocols. How often will there be meetings? What’s the preferred channel for urgent messages? Establishing these practicalities helps maintain a smooth operational flow. It ensures that both sides know how to connect and share vital information effectively and efficiently.

Finally, a good accounting SLA includes provisions for problem resolution and even termination. Life isn’t always smooth, and sometimes issues arise despite best intentions. Having a pre-agreed process for addressing grievances, escalating problems, and even gracefully exiting the agreement if necessary, provides a safety net for both parties. It shows foresight and a commitment to professional conduct from start to finish.

Benefits of Having a Solid Accounting SLA

Implementing a robust accounting service level agreement brings a multitude of advantages that extend beyond just formalizing a relationship. Primarily, it fosters unparalleled clarity. By meticulously detailing every aspect of the service, from deliverables to timelines and responsibilities, it eliminates assumptions and ensures that both the client and the accounting firm have a shared understanding of what’s expected. This clarity is the bedrock of any successful professional engagement.

Moreover, a well-defined SLA significantly enhances accountability. When performance metrics are clearly outlined and agreed upon, the service provider has a tangible benchmark against which their work can be measured. Similarly, the client understands their obligations in providing necessary information or approvals, ensuring a collaborative effort. This mutual accountability drives efficiency and promotes a higher standard of service delivery.

- **Clear Expectations:** Both parties know exactly what to expect from each other.

- **Enhanced Accountability:** Defines responsibilities and measurable performance standards.

- **Improved Communication:** Establishes clear channels and frequencies for interaction.

- **Dispute Prevention:** Reduces misunderstandings by addressing potential issues upfront.

- **Professionalism and Trust:** Demonstrates a commitment to quality and a structured approach.

- **Better Resource Allocation:** Helps both sides plan and manage their resources more effectively.

Ultimately, an SLA helps build a foundation of trust and professionalism. It demonstrates that the accounting firm is committed to delivering a high-quality, transparent service, and that the client values a structured, professional relationship. This level of transparency and commitment not only prevents common pitfalls but also sets the stage for a more productive and harmonious working relationship, allowing everyone to focus on strategic financial goals rather than operational ambiguities.

Having a clear agreement in place acts as a powerful tool for safeguarding the interests of both the accounting service provider and their client. It sets the tone for a professional relationship built on transparency, mutual understanding, and shared objectives, significantly reducing the chances of miscommunication and unmet expectations.

If you’re looking to formalize your accounting relationships and ensure smooth, efficient operations, starting with an accounting service level agreement template is an excellent step. It provides a solid framework that you can customize to fit your specific needs, ensuring all parties are aligned for success.