Navigating the world of financial agreements can sometimes feel like trying to solve a complex puzzle, especially when it involves debt. Whether you are a creditor looking to transfer an outstanding balance to another party or an individual involved in a business transaction that requires the formal transfer of financial obligations, having the right legal documentation is crucial. This is where an assignment of debt agreement template becomes an invaluable tool, providing a clear and structured way to handle such transfers legally and efficiently.

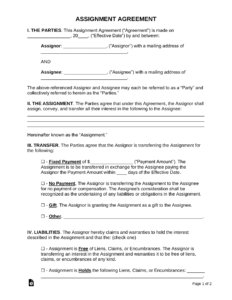

Essentially, an assignment of debt is a legal process where the rights to collect a debt are transferred from the original creditor (the assignor) to a new party (the assignee). This could happen for various reasons, such as a company selling off its uncollected debts to a debt collection agency, or as part of a larger asset sale where financial liabilities are bundled together. Without a properly drafted agreement, the transfer can be murky, leading to potential disputes and legal challenges down the road.

Using a well-structured template ensures that all necessary legal provisions and terms are included, protecting the interests of all parties involved. It streamlines the process, making sure no critical details are overlooked and providing a clear record of the transaction. This foundational document helps to establish who owes what, to whom, and under what conditions, offering peace of mind and legal clarity.

Understanding The Basics Of Debt Assignment

When we talk about assigning debt, we’re essentially discussing the transfer of a contractual right. The original creditor, known as the assignor, gives up their right to collect payment from the debtor. This right is then passed on to a new party, the assignee, who then assumes the role of the creditor and gains the legal right to pursue the debt. This isn’t just a casual handshake; it’s a formal legal act that requires careful documentation to be enforceable. Imagine a bank selling off a portfolio of overdue credit card accounts to a specialized collection agency. The bank is the assignor, the collection agency is the assignee, and the credit card holders are the debtors.

There are many reasons why an assignment might take place. Sometimes, it’s about a company focusing on its core business and offloading non-performing assets to firms better equipped to handle collections. Other times, it’s part of a merger or acquisition, where all assets and liabilities, including debts, are transferred as part of the deal. Whatever the motivation, the core principle remains the same: a legal transfer of the right to collect a specific debt.

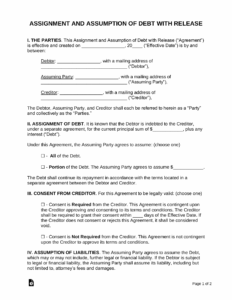

The agreement itself needs to be robust and unambiguous. It must clearly identify the parties involved, the specific debt being assigned, and the terms of the assignment. Without this clarity, the debtor might not know who to pay, or worse, both the assignor and assignee could attempt to collect the same debt, leading to confusion and potential legal issues.

Key Elements To Look For In Your Template

When you’re working with an assignment of debt agreement template, you’ll want to ensure it includes several critical components to make it legally sound and effective. These elements provide the framework for the entire transaction and protect everyone involved.

- Identification of Parties: Clearly state the full legal names and addresses of the assignor (original creditor), the assignee (new creditor), and the debtor.

- Description of Debt: Provide a detailed description of the debt being assigned, including the original amount, any outstanding balance, the original agreement or contract under which the debt arose, and any relevant account numbers.

- Effective Date: Specify the exact date on which the assignment becomes legally effective.

- Consideration: State what the assignee is providing in exchange for the debt (e.g., a specific payment amount, other services). This is crucial for the agreement’s enforceability.

- Warranties and Representations: The assignor typically warrants that the debt is valid, enforceable, and that they have the legal right to assign it.

- Governing Law: Indicate which jurisdiction’s laws will govern the agreement, which is particularly important for interstate or international assignments.

Ensuring these elements are present and accurately filled out will prevent misunderstandings and provide a solid legal foundation for the debt transfer. It’s about laying out all the facts clearly so there’s no room for doubt or misinterpretation. A well-prepared template guides you through capturing all this essential information, saving you time and reducing the risk of errors.

Why A Template Is Your Best Friend

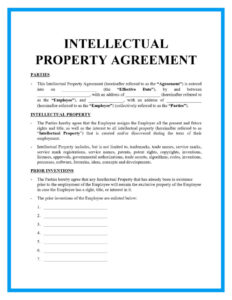

Utilizing an assignment of debt agreement template isn’t just a matter of convenience; it’s a strategic move for efficiency and legal accuracy. These templates are typically designed by legal professionals, meaning they already incorporate standard clauses and legal language that are essential for such an agreement to hold up in court. Instead of starting from scratch and potentially overlooking critical legal requirements, you begin with a solid framework that simply needs customization to fit your specific situation. This saves a significant amount of time and reduces the need for extensive legal research on your part.

Beyond just saving time, a good template acts as a checklist, ensuring that you include all the necessary information and legal provisions. It prompts you to fill in details such as the identities of all parties, the specifics of the debt, and any warranties or conditions related to the assignment. This comprehensive approach minimizes the risk of errors or omissions that could render the agreement unenforceable or lead to future legal disputes. It’s about building a robust document that clearly outlines the rights and responsibilities of each party.

Once you’ve filled out your template, it’s not quite done. It’s imperative to have all parties review the document thoroughly and sign it in accordance with legal requirements, which often includes witnessing or notarization depending on your jurisdiction and the value of the debt. Remember to provide official notice to the debtor about the assignment, informing them of the change in creditor and where to direct future payments. This notification is vital to ensure the debtor is aware of their new payment obligations and to prevent any further payments to the original creditor.

A well-executed assignment of debt agreement provides clarity and legal protection for everyone involved in the transfer of financial obligations. It’s more than just a piece of paper; it’s a foundational document that ensures smooth transitions and helps avoid future complications. By carefully drafting and executing this agreement, you contribute to a transparent and legally sound financial environment for all parties.