Navigating the complexities of financial transactions can often feel like a puzzle, especially when you need to direct funds from one source to another without directly handling them yourself. Whether you’re dealing with a legal settlement, an escrow account, or a business deal, sometimes you need a formal way to ensure that a specific portion of anticipated funds goes directly to a third party. This is where a clear and legally sound document becomes not just helpful, but essential.

Imagine a scenario where you’re expecting a large payment, but you owe a portion of it to a creditor, a business partner, or even a family member. Instead of receiving the full amount and then manually distributing it, an agreement can be set up to streamline this process. This mechanism ensures that the designated recipient gets their share directly from the original payer. A well-crafted assignment of proceeds agreement template simplifies this entire process, providing a structured framework for such arrangements.

Having a reliable template at your fingertips means you can confidently enter into these arrangements, knowing that all parties involved understand their roles and the flow of funds is clearly defined. It helps prevent misunderstandings, disputes, and potential delays, offering peace of mind and legal clarity in various financial and contractual situations.

What is an Assignment of Proceeds Agreement and Why Do You Need One?

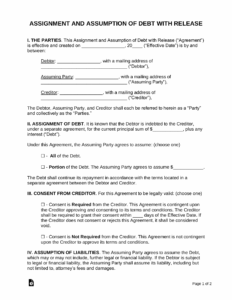

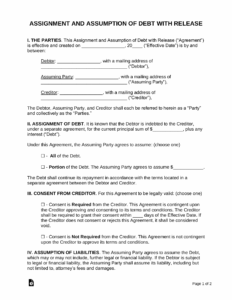

An assignment of proceeds agreement is a legal document that formally directs a third party (the assignor) to transfer a specified portion of funds, which they are expecting to receive, directly to another party (the assignee). Essentially, it’s like giving someone a legal instruction to pay someone else on your behalf from money that would otherwise come to you. This might sound straightforward, but the legal framework ensures it is binding and enforceable, protecting all involved parties.

This type of agreement is incredibly versatile and finds application in numerous scenarios. For instance, in real estate transactions, a seller might assign a portion of their sale proceeds directly to a lender or a real estate agent. In legal settlements, a plaintiff might assign a part of their award to cover medical expenses or legal fees. Businesses often use them to direct payment from a client to a subcontractor or a financial institution. It’s a powerful tool for managing financial obligations efficiently and transparently, avoiding the need for an intermediate step where the original recipient handles and then redistributes the funds.

The primary benefit of using an assignment of proceeds agreement is the clarity and security it offers. It legally binds the original payer (often called the obligor) to divert funds as specified, minimizing the risk of funds being misdirected or delayed. For the assignee, it provides a direct claim to the funds, enhancing their security. For the assignor, it streamlines their financial obligations, removing the burden of having to manually process and forward payments. It ensures that debts or agreements are settled promptly and correctly without additional administrative steps.

Understanding the roles involved is crucial. The "assignor" is the party who is originally entitled to the proceeds but chooses to direct a portion to someone else. The "assignee" is the party who will actually receive the assigned proceeds. Finally, the "obligor" is the party who is responsible for paying the funds in the first place and is now directed to pay the assignee directly. A clear agreement spells out these relationships and responsibilities, leaving no room for ambiguity.

Without a formal agreement, simply requesting a payment diversion might not hold up legally, leaving room for disputes or non-compliance. A properly executed assignment ensures that the instruction is legally binding and can be enforced if necessary, making it an indispensable tool for complex financial arrangements where precision and legal certainty are paramount.

Key Elements to Look For in a Template

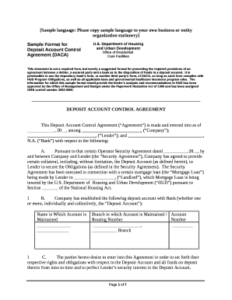

- **Identification of Parties:** Clearly name and identify the assignor, assignee, and obligor.

- **Clear Definition of Proceeds:** Precisely describe the source and amount of funds being assigned.

- **Assignment Clause:** The core statement where the assignor formally assigns their right to the proceeds.

- **Revocation or Termination Conditions:** Outline if and how the agreement can be ended or modified.

- **Governing Law:** Specify which state or country’s laws will govern the agreement.

- **Signatures and Dates:** Ensure all necessary parties sign and date the document to make it legally binding.

Tailoring Your Assignment of Proceeds Agreement Template

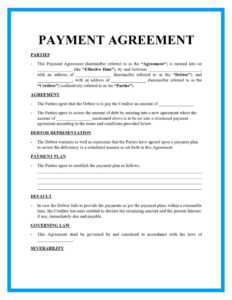

While an assignment of proceeds agreement template provides an excellent starting point, it’s rarely a one-size-fits-all solution. Every financial transaction has its unique nuances, and the effectiveness of your agreement hinges on how well it reflects those specific details. Simply filling in blanks might not be enough; a truly robust agreement requires thoughtful customization to align with your particular situation, the nature of the proceeds, and the relationships between all parties involved.

Consider factors like the specific industry you’re operating in, which might have its own regulations or common practices. State laws can also significantly impact how an assignment of proceeds is viewed and enforced, so ensuring compliance with local jurisdiction is vital. Furthermore, the type of proceeds being assigned—whether it’s a fixed sum, a percentage, or contingent on certain events—will dictate how the agreement needs to be worded. A template offers the framework, but you’re responsible for populating it with precise and context-appropriate language.

Before finalizing any document, take the time to review each clause carefully, even if you’re using a pre-existing assignment of proceeds agreement template. Ask yourself if the language is unambiguous, if all foreseeable circumstances are addressed, and if it truly represents the intentions of everyone involved. Seeking legal counsel to review your customized agreement is always a wise step, especially for significant financial transactions, as it can help identify potential pitfalls or missed clauses that could lead to complications down the line.

- Consider specific payment schedules or conditions that might trigger the assignment.

- Define clear timelines for when the assignment becomes effective and when payments are expected.

- Address how potential disputes related to the proceeds will be resolved.

- Ensure that the agreement is compliant with any industry-specific regulations or licensing requirements.

An effective assignment of proceeds agreement is a powerful instrument for streamlining financial flows and ensuring obligations are met without friction. By carefully selecting and customizing a reliable template, you can create a document that provides clarity, security, and legal enforceability for all parties involved, simplifying complex transactions into manageable and transparent processes. Taking the time to understand and properly prepare this document can save considerable time, effort, and potential legal headaches in the future.