Starting a business is a whirlwind of excitement, late nights, and big dreams. You and your co-founder are a force, tackling challenges, sharing a vision, and building something incredible from the ground up. It’s a partnership fueled by passion, trust, and shared ambition, and in those early days, it feels like nothing could ever go wrong.

However, even the strongest partnerships can face unexpected turns. Visions might diverge, personal circumstances can change, or simply, the working relationship might no longer be sustainable. This isn’t a sign of failure, but rather a common reality in the dynamic world of startups. It’s precisely why having a robust co founder separation agreement template in place from the outset, or at least early on, is not just wise, but absolutely crucial for the health and longevity of your venture.

Thinking about a separation agreement might feel pessimistic when you’re just starting out, but consider it an essential piece of your business’s foundational planning, much like a business plan or an operating agreement. It’s about preparing for all possibilities, ensuring that if a co-founder leaves, the process is clear, fair, and minimizes disruption to the business you’ve both worked so hard to build. It protects everyone involved, allowing for a smoother transition during what can often be a challenging time.

The Indispensable Value of a Co-Founder Separation Agreement

Imagine a scenario where a co-founder decides to step down. Perhaps they’ve found a new opportunity, want to pursue a different passion, or maybe the partnership simply isn’t working anymore. Without a pre-agreed framework, this situation can quickly devolve into a messy, emotionally charged, and financially draining dispute. Discussions around equity, intellectual property, and ongoing responsibilities become subjective and open to interpretation, often leading to stalemates that harm the company and the remaining founders.

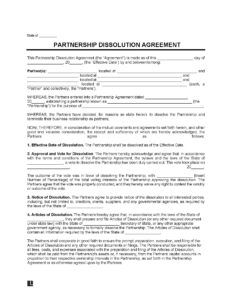

The primary role of a co-founder separation agreement is to remove ambiguity. It lays out a clear roadmap for what happens when a founder departs, establishing parameters for everything from who owns what to how decisions will be made post-separation. This proactive approach prevents potential legal battles, saves significant legal fees, and, perhaps most importantly, protects the operational continuity and future viability of the company. It allows the business to move forward without being bogged down by unresolved past issues.

Think of it as an insurance policy for your startup. You hope you never need it, but if you do, you’ll be incredibly grateful it’s there. It codifies the terms of disengagement, ensuring that the hard work, investments, and intellectual property developed by the company remain protected, rather than becoming entangled in personal disputes. This clarity helps maintain investor confidence and allows remaining team members to focus on growth rather than internal conflicts.

Critical Components Your Agreement Must Address

When you’re looking at a co founder separation agreement template, you’ll notice it covers a wide array of potential issues. Each clause is designed to preemptively address common points of contention, ensuring that the departure of a co-founder is handled systematically and fairly for all parties, including the departing founder, the remaining founders, and the company itself. These elements are the backbone of a successful and amicable separation.

- **Equity Vesting and Buyout:** This is often the most contentious point. The agreement should clearly define what happens to the departing founder’s equity, especially if it’s not fully vested. Will there be a buyout? At what valuation? What are the payment terms?

- **Intellectual Property (IP) Rights:** Who owns the IP created during the founder’s tenure? Typically, it belongs to the company, but the agreement should explicitly state this and ensure all necessary assignments are made.

- **Confidentiality:** Even after departure, the former co-founder will have knowledge of sensitive company information. A strong confidentiality clause prevents them from disclosing this information.

- **Non-Compete and Non-Solicitation Clauses:** These clauses can prevent a departing founder from immediately starting a competing business or poaching employees and clients. Their scope and enforceability vary by jurisdiction, so professional advice is crucial here.

- **Debt and Liabilities:** Clearly outline how shared debts, guarantees, or ongoing liabilities of the company will be handled and what responsibility the departing founder retains.

- **Dispute Resolution:** In case disagreements arise during the separation process, the agreement should specify a method for resolution, such as mediation or arbitration, to avoid costly litigation.

- **Public Announcements and Communications:** Define how the departure will be communicated to employees, investors, clients, and the public to maintain a consistent company message.

- **Transitional Responsibilities:** Detail any ongoing responsibilities the departing founder might have during a transition period, such as assisting with knowledge transfer or client handover.

By carefully addressing each of these points within your agreement, you create a robust framework that anticipates potential issues and provides clear solutions. This foresight minimizes stress, protects the company’s assets, and allows everyone involved to move forward with certainty. It’s a foundational step in building a resilient and sustainable business.

Navigating the Search and Customization of Your Template

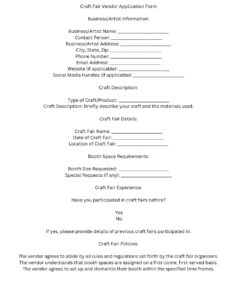

The digital landscape offers a wealth of resources when you’re looking for a co-founder separation agreement template. You’ll find various options available from legal tech platforms, online document providers, and even some law firm websites. When searching, prioritize sources that are reputable and offer templates drafted by legal professionals. While a free template might be tempting, ensure it’s comprehensive and covers the critical elements discussed earlier. Often, a paid or premium template will offer more robust and customizable clauses.

Remember, a template is just that a starting point. Your business is unique, with its own specific circumstances, equity structure, and operational dynamics. Therefore, customization is not just recommended, it’s essential. Don’t simply fill in the blanks; review each clause carefully, considering how it applies to your specific situation. Discuss the terms openly and honestly with your co-founder (if the agreement is being drafted in anticipation of a potential future separation) or with legal counsel (if you’re already in the process of separation). Tailoring the document to reflect your mutual understanding and the particularities of your venture ensures it truly serves its purpose.

Even the best template can’t replace professional legal advice. Once you’ve drafted an agreement using a template, it’s highly advisable to have it reviewed by an attorney specializing in corporate or startup law. A lawyer can identify any potential pitfalls, ensure the agreement complies with local laws and regulations, and confirm that it adequately protects the interests of both the company and the founders involved. This legal review is an investment that can save you immense time, money, and heartache down the line, solidifying the document’s enforceability and fairness.

Proactively addressing the possibility of a co-founder separation isn’t about expecting the worst; it’s about intelligent, forward-thinking business planning. Just as you plan for growth and success, preparing for potential departures ensures that your company can weather any changes in its leadership structure without significant collateral damage. It’s a testament to responsible entrepreneurship, valuing clarity and fairness above all else.

By utilizing a well-crafted co-founder separation agreement template and ensuring it’s properly customized and legally vetted, you establish a solid foundation for your business’s future, no matter who is at the helm. This thoughtful preparation allows everyone involved to move forward with confidence, preserving the integrity of the business and minimizing personal strife during challenging transitions.