Navigating the world of commercial real estate financing can often feel like a complex maze, with numerous parties involved and significant sums of money at stake. For businesses seeking capital, working with an experienced commercial mortgage broker is often the smartest path, as these professionals possess the expertise and network to secure the best possible terms. However, just like any professional service, it is paramount to clearly define the working relationship and, most importantly, the compensation structure right from the outset.

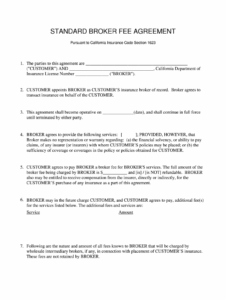

This is precisely where a robust commercial mortgage broker fee agreement template becomes an indispensable tool. It serves as a foundational document that outlines the terms and conditions under which the broker will operate on behalf of their client, detailing the services to be provided, the scope of their authority, and critically, how and when they will be paid for their successful efforts. Having such an agreement in place protects both the broker by ensuring their hard work is compensated and the client by providing transparency and predictability regarding costs.

Without a well-drafted agreement, misunderstandings can easily arise, potentially leading to disputes that can sour relationships and even derail a critical financing deal. It ensures that all parties are on the same page regarding expectations, responsibilities, and the financial implications of the engagement, fostering a sense of trust and professionalism from the beginning of the transaction to its successful close.

Why a Solid Fee Agreement is Non-Negotiable

A clearly articulated fee agreement is the bedrock of any successful commercial mortgage brokerage relationship. It eliminates ambiguity regarding the broker’s remuneration, preventing uncomfortable conversations and potential legal battles down the line. Imagine dedicating significant time and resources to sourcing a complex commercial loan, only for the client to dispute the fee structure at the closing table because it was never formally documented. This scenario, unfortunately, is not uncommon when agreements are vague or non-existent.

For the client, a detailed fee agreement offers peace of mind. They understand exactly what they are committing to, how the fees are calculated, and under what circumstances they become payable. This transparency builds confidence and allows the client to budget effectively for the financing costs, ensuring there are no unpleasant surprises when the deal is nearing completion. It truly defines the scope of work and the financial commitment upfront.

The agreement also establishes the legal framework for the relationship, outlining remedies in case of breach by either party. It can specify dispute resolution mechanisms, governing law, and other critical legal protections that safeguard the interests of both the broker and the client. This professional approach signifies due diligence and a commitment to fair business practices from both sides.

Key Elements to Include in Your Template

- **Identification of Parties:** Clearly state the legal names and contact information for both the commercial mortgage broker and the client seeking financing.

- **Description of Services:** Detail the specific services the broker will provide, such as identifying lenders, negotiating terms, assisting with applications, and facilitating the closing process.

- **Brokerage Fee Calculation:** Explain how the fee will be determined. Is it a percentage of the loan amount, a flat fee, or a success-based fee payable only upon funding? Provide clear examples if necessary.

- **Payment Schedule:** Outline when the fee is due. Common triggers include loan commitment, loan closing, or a specific date. Clarify if any portion is an upfront retainer.

- **Exclusivity Clause:** If the broker is granted an exclusive right to arrange financing for a specific property or project for a defined period, this must be explicitly stated.

- **Term and Termination:** Specify the duration of the agreement and the conditions under which either party can terminate it, including notice periods and any potential break-up fees.

- **Confidentiality and Indemnification:** Include clauses to protect sensitive information and to indemnify the broker against certain liabilities.

- **Governing Law and Dispute Resolution:** Indicate which state’s laws will govern the agreement and how any disputes will be resolved, whether through arbitration or litigation.

While a commercial mortgage broker fee agreement template provides a fantastic starting point, it is crucial to remember that it is a living document. Each transaction and client relationship might have unique facets that require customization. Using a template allows for efficiency but should always be followed by a thorough review and potential modifications to accurately reflect the specific deal at hand. This adaptability ensures that the agreement remains relevant and enforceable for every engagement.

Navigating Different Fee Structures and Contingencies

The financial landscape for commercial mortgage brokerage fees is not a one-size-fits-all scenario; brokers employ various fee structures depending on the complexity of the deal, market conditions, and their own business models. Understanding these different approaches and clearly documenting them within the agreement is essential for managing expectations and ensuring a smooth transaction. Common structures include a percentage of the loan amount, a fixed flat fee, or a hybrid model involving an upfront retainer combined with a success fee upon closing. Each method has its own implications for both the broker and the client.

A percentage-based fee, for instance, directly ties the broker’s compensation to the size of the loan secured. This can motivate brokers to achieve the largest possible financing package for their client, but it also means the client’s fee scales with the loan amount. Conversely, a flat fee provides cost certainty for the client from the outset, regardless of the final loan size, though brokers must carefully assess their expected workload when setting such a fee to ensure fair compensation for their efforts.

It is also vital for the agreement to address contingencies. What happens if the deal falls through due to no fault of the broker? Are there any circumstances under which a fee might still be partially payable? What if the client decides to withdraw after significant work has been performed? Clearly outlining these potential scenarios and the financial repercussions within the commercial mortgage broker fee agreement template helps prevent disputes and provides a roadmap for various outcomes. Such foresight contributes significantly to a stable and professional business relationship.

A well-crafted fee agreement acts as a safeguard and a facilitator, ensuring that both parties understand their roles, responsibilities, and the financial aspects of their collaboration. It sets a professional tone from the outset, promoting trust and transparency throughout the commercial mortgage financing process. Taking the time to establish such a document lays the groundwork for successful, mutually beneficial transactions, allowing businesses to secure the capital they need with confidence and clarity.