Life happens, and sometimes employees find themselves in a tight spot financially, needing a little extra help before their next paycheck. As an employer, you might want to offer a helping hand, but it’s crucial to do so in a structured and professional way. This is where an employee cash advance agreement template becomes incredibly valuable, providing a clear framework for both parties to understand the terms of the loan.

Offering a cash advance can be a great way to support your team, fostering loyalty and demonstrating care. However, without a clear, written agreement, what starts as a helpful gesture can quickly lead to misunderstandings, administrative headaches, and even legal disputes. A well-drafted agreement ensures that both the company and the employee are on the same page regarding the advance, its repayment, and any associated conditions.

Having a standardized template not only saves you time but also ensures consistency across your organization. It helps you manage expectations, protect your business’s financial interests, and maintain positive employee relations. Let’s dive into why such a document is indispensable and what key elements you should always include.

Why a Formal Agreement is Your Best Friend

Imagine a scenario where an employee asks for a cash advance. You agree verbally, hand over the money, and then when payday comes, they claim they never agreed to a deduction, or they thought it was a gift. This kind of miscommunication is unfortunately common when there’s no written record. A formal agreement eliminates ambiguity, setting clear expectations from the outset for both the employer and the employee.

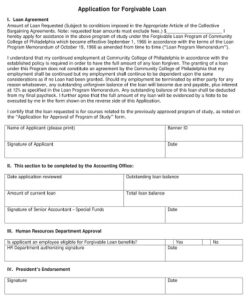

From the employer’s perspective, this document serves as legal protection. It outlines the specific amount advanced, the agreed-upon repayment schedule, and the method of repayment, such as payroll deductions. This means if there’s ever a dispute, you have a signed document detailing the understanding between both parties, which can be invaluable in upholding your company’s policy and financial integrity.

For the employee, the agreement offers transparency. They know exactly what they are signing up for, how much they need to repay, and when. This clarity helps them manage their finances better and avoids any unpleasant surprises on their paycheck. It demonstrates that your company handles these situations fairly and professionally, building trust.

Think of it as a blueprint for a smooth transaction. Without it, you’re building without a plan, risking structural weaknesses and potential collapse. With it, every step is clear, every expectation managed, and every obligation understood. It’s about creating a win-win situation where support can be offered without creating future problems.

Key Elements for Your Employee Cash Advance Agreement Template

When drafting or customizing an employee cash advance agreement template, several critical components must be included to ensure its effectiveness and enforceability. Missing even one element can undermine the entire purpose of the document.

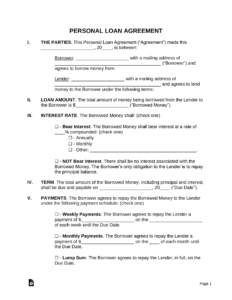

- **Clear Identification of Parties**: Always include the full legal name of the employer and the employee, along with their respective addresses. This ensures there’s no confusion about who is entering into the agreement.

- **Advance Amount**: State the exact monetary amount of the cash advance in both numbers and words to prevent any misunderstandings or alterations.

- **Repayment Terms**: This is perhaps the most crucial section. Detail the repayment schedule (e.g., weekly, bi-weekly, monthly), the amount of each payment, and the specific dates deductions will occur. Specify the method of repayment, most commonly through payroll deductions.

- **Authorization for Payroll Deduction**: Explicitly state that the employee authorizes the employer to deduct the advance amount from their future paychecks until the full sum is repaid. This authorization is vital for legal deductions.

- **Default Clause**: What happens if the employee leaves the company before the advance is fully repaid? The agreement should clearly state that any remaining balance will be deducted from their final paycheck, including any accrued vacation pay or other final compensation, to the extent permitted by law.

- **No Interest or Fees (Usually)**: Most employee cash advances are interest-free. If there are any fees or interest, they must be clearly disclosed. However, for simplicity and employee goodwill, most companies avoid charging interest.

- **Acknowledgement**: A statement confirming that the employee understands and agrees to all terms and conditions of the advance.

- **Signatures and Date**: Both the employer (or an authorized representative) and the employee must sign and date the agreement. This signifies mutual consent and makes the document legally binding.

By including these detailed points, your agreement will be robust and clear, leaving little room for misinterpretation. It’s about precision and foresight.

Implementing and Managing Your Cash Advance Policy

Beyond having a solid employee cash advance agreement template, the success of any cash advance program hinges on how you implement and manage it within your organization. It’s not just about the document itself, but the entire process surrounding it. Establishing a clear, communicated policy is the first step.

Your policy should define eligibility criteria, such as minimum employment tenure or being in good standing, and outline the maximum amount an employee can request. It should also specify the frequency with which advances can be requested and any circumstances under which an advance might be denied. Make sure this policy is easily accessible to all employees, perhaps in an employee handbook or on your company intranet.

Once a policy is in place, consistent application is key. Treat all advance requests fairly and according to the established rules. When an employee requests an advance, walk them through the agreement, ensuring they understand all terms before signing. Maintain thorough records of all advances, including the signed agreements, repayment schedules, and a running balance of outstanding amounts. This meticulous record-keeping is crucial for financial tracking and compliance.

A well-managed cash advance system can be a powerful tool for employee support and retention. It fosters an environment where employees feel valued and supported, knowing that their employer can offer a safety net during unexpected financial needs. This human-centric approach, backed by solid administrative practices, contributes significantly to a positive workplace culture.

Ultimately, a carefully constructed agreement and a transparent policy protect your business while providing a valuable benefit to your employees. It’s about striking a balance between offering assistance and ensuring responsible financial management for all parties involved, strengthening the trust between you and your team.