Companies often look for innovative ways to attract top talent, retain valuable employees, and incentivize specific behaviors. One increasingly popular method is the use of an employee forgivable loan. Instead of a traditional bonus or raise, this financial tool offers a lump sum that, under the right conditions, never needs to be repaid. It is a strategic investment in an employee’s future with the company.

However, like any financial arrangement, clarity is paramount. Both the employer and the employee need to understand the terms, conditions, and expectations surrounding such a loan. This is where an employee forgivable loan agreement template becomes an invaluable resource, providing a structured framework to outline all the critical details and protect both parties from potential misunderstandings down the road.

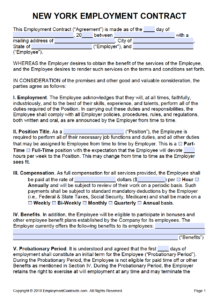

This kind of agreement ensures that the purpose of the loan, the conditions for its forgiveness, and the obligations in case of non-forgiveness are all laid out explicitly. It transforms what could be a vague verbal promise into a legally binding document, fostering trust and transparency within the employment relationship.

Understanding the Core Elements of a Forgivable Loan Agreement

A forgivable loan is essentially a sum of money advanced to an employee that the employee is not required to pay back, provided they meet certain specified conditions. Think of it as a commitment from the employer and a performance or tenure obligation from the employee. It is not just a gift; it is a loan with a built-in mechanism for cancellation.

These loans are typically utilized in several key scenarios. Companies might offer them as a sign-on bonus to attract highly sought-after candidates, particularly for executive roles or positions with specialized skills. They can also serve as a powerful retention tool, encouraging employees to remain with the company for a predefined period. Sometimes, they are tied to specific performance metrics or relocation assistance, helping an employee with moving costs in exchange for their long-term commitment.

Given the nuanced nature of these arrangements, a robust employee forgivable loan agreement template is absolutely critical. It serves as the single source of truth for all terms and conditions, leaving no room for ambiguity. Without a clear agreement, what seems like a straightforward deal can quickly devolve into confusion or even legal disputes.

Key Provisions to Include

A comprehensive agreement should cover several fundamental areas to ensure absolute clarity for both parties.

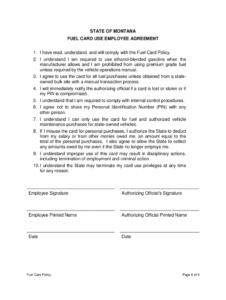

First, the document must clearly state the loan amount and how it will be disbursed.

- Principal Amount: The exact sum being lent to the employee.

- Disbursement Date: When the loan amount will be provided to the employee.

- Method of Disbursement: Whether it is a direct deposit, check, or other means.

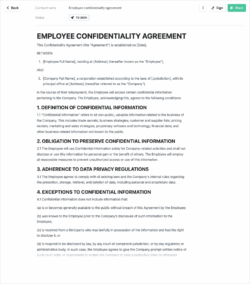

Next, and perhaps most crucially, are the forgiveness conditions. This is the heart of any forgivable loan agreement, detailing exactly what an employee needs to do for the loan to be forgiven. These conditions are typically tied to the employee’s continued service with the company.

- Service Period: The length of time the employee must remain employed for the loan to be forgiven, often with a clear start and end date.

- Performance Metrics: In some cases, forgiveness might be partially or wholly dependent on achieving specific performance goals or targets.

- Vesting Schedule: Often, forgiveness is not an all-or-nothing proposition. A vesting schedule might dictate that a certain percentage of the loan is forgiven each year or quarter the employee remains with the company.

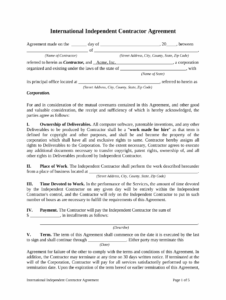

Equally important are the repayment obligations. What happens if the forgiveness conditions are not met? The agreement must clearly spell out the circumstances under which the loan, or a portion of it, becomes repayable.

- Triggering Events for Repayment: This typically includes voluntary termination by the employee, termination for cause by the employer, or failure to meet performance targets.

- Repayment Schedule and Interest: If repayment is triggered, the agreement should detail how and when the loan must be repaid, including any applicable interest rates, payment plans, or deadlines.

- Offsetting against final paychecks: Many agreements include a clause allowing the employer to offset any outstanding loan balance against the employee’s final salary, vacation pay, or other amounts due upon termination.

Finally, the agreement should address legalities and governing law. It should specify which state’s laws will govern the interpretation and enforcement of the agreement and include standard contractual clauses such as an entire agreement clause, which states that the document represents the complete and final understanding between the parties.

Benefits of a Well-Crafted Forgivable Loan Agreement

For employers, a thoughtfully designed forgivable loan agreement offers numerous advantages. It acts as a powerful incentive for employee retention, as individuals are more likely to stay with a company to meet forgiveness conditions rather than having to repay a substantial loan. This stability can significantly reduce recruitment and training costs associated with high turnover. Moreover, it allows companies to offer attractive compensation packages that stand out in competitive markets, often providing an immediate financial boost to the employee without the same immediate tax implications as a bonus.

Employees also benefit from clear terms. They receive upfront financial support that can be used for various personal needs, from down payments on homes to educational expenses, with the understanding that this “loan” can effectively become theirs if they fulfill their commitment to the company. The transparency provided by a formal agreement eliminates guesswork, allowing employees to fully understand their obligations and the path to loan forgiveness.

Ultimately, a precise and legally sound employee forgivable loan agreement template mitigates potential disputes for both parties. It lays out all scenarios and expectations upfront, preventing misunderstandings that could otherwise lead to costly legal battles or damaged professional relationships. By clearly defining the terms of the loan and its forgiveness, it fosters a relationship built on mutual understanding and clear boundaries.

Implementing a well-structured employee forgivable loan agreement template can be a strategic move for any organization looking to leverage this compensation tool effectively. It provides a solid foundation for a mutually beneficial arrangement, ensuring that both the company’s investment and the employee’s commitment are clearly defined and protected. Taking the time to craft or customize such an agreement ensures legal compliance and sets clear expectations, paving the way for successful outcomes for all involved.