Stepping into the world of independent insurance agency can be incredibly rewarding, offering the freedom to manage your own book of business and chart your own professional course. However, with great independence comes the responsibility of clearly defining your professional relationships. Many agents and agencies overlook the critical importance of a robust, well-defined agreement that outlines the terms of their collaboration, leading to misunderstandings and potential disputes down the line.

That’s where an independent insurance agent agreement template becomes an invaluable tool. It serves as the foundational document that articulates the rights, responsibilities, and expectations for both the agent and the principal agency or carrier. Having a clear, written agreement in place protects everyone involved, ensuring that compensation structures, client ownership, non-compete clauses, and termination procedures are all explicitly understood from the outset.

Navigating these intricacies without a proper framework can be like building a house without blueprints – you might get something functional, but it’s prone to structural issues. A comprehensive agreement fosters transparency and trust, allowing agents to focus on what they do best: serving clients and growing their business, rather than worrying about ambiguous contractual terms.

Crafting a Solid Foundation: What Your Agreement Should Cover

A well-drafted independent insurance agent agreement is much more than just a formality; it’s a strategic document that safeguards your business interests and ensures a smooth, professional relationship. It prevents future headaches by addressing potential areas of conflict before they even arise. Think of it as your roadmap for a successful partnership, whether you’re an agency bringing on independent producers or an agent joining a larger organization. It’s about clarity, not just compliance.

Without a strong agreement, questions about who owns the client relationships if an agent leaves, how commissions are paid on renewals, or what constitutes a breach of contract can quickly escalate. These ambiguities can lead to costly legal battles and damaged reputations. A clear agreement sets the rules of engagement, allowing both parties to operate with confidence and predictability. It’s designed to provide a mutually beneficial framework, not to create barriers.

One of the most crucial aspects of any such agreement is defining the scope of the agent’s authority. Are they authorized to bind coverage, or only to solicit applications? What products can they sell? Understanding these limits is vital for both the agent, who needs to operate within their legal boundaries, and the agency, which bears ultimate responsibility for the agent’s actions. This section should be unambiguous, leaving no room for interpretation regarding the agent’s capabilities and limitations.

Essential Elements to Include in Your Template

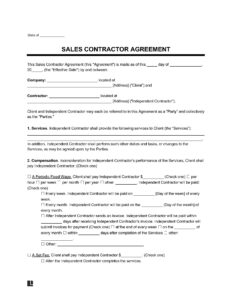

- **Identification of Parties:** Clearly state who the agent is and who the principal agency or carrier is, including their legal names and addresses.

- **Purpose of Agreement:** Briefly outline the intent, which is typically to establish the terms of an independent contractor relationship for the sale of insurance products.

- **Independent Contractor Status:** Explicitly state that the agent is an independent contractor, not an employee. This is critical for tax purposes and liability.

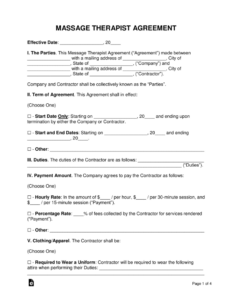

- **Term and Termination:** Specify the agreement’s duration and the conditions under which either party can terminate it, including notice periods and any penalties or obligations upon termination.

- **Compensation Structure:** Detail how the agent will be paid, including commission rates, bonus structures, renewal commissions, and payment schedules. Clarity here avoids many disputes.

- **Ownership of Accounts/Expirations:** This is often a contentious area. The agreement must clearly define who owns the book of business, client data, and policy expirations, especially upon termination.

- **Non-Solicitation and Non-Compete Clauses:** If applicable, outline any restrictions on the agent soliciting clients or competing with the agency after termination, specifying duration and geographic scope.

- **Confidentiality:** Protect proprietary information, client lists, and trade secrets.

- **Errors and Omissions (E&O) Insurance:** Stipulate E&O requirements for the agent, including minimum coverage limits.

- **Compliance with Laws and Regulations:** State that the agent must adhere to all applicable state and federal insurance laws.

- **Indemnification:** Outline how each party will protect the other from legal liabilities arising from their actions.

- **Governing Law:** Specify which state’s laws will govern the agreement in case of a dispute.

A clear articulation of these points within an independent insurance agent agreement template ensures that both parties enter into the relationship with open eyes and a shared understanding, paving the way for a productive and long-lasting partnership built on mutual respect and clearly defined terms.

Customizing Your Agreement for Unique Partnerships

While an independent insurance agent agreement template provides an excellent starting point, it’s crucial to understand that no two partnerships are exactly alike. Relying solely on a generic template without any customization can leave significant gaps that might not address the specific nuances of your arrangement. Think of it as buying a suit off the rack – it might fit okay, but a tailored one will always look and feel better, and more importantly, serve its purpose flawlessly.

The specifics of your business model, the types of insurance products involved, the geographic reach of the agent, and the level of support provided by the principal agency all necessitate a thoughtful review and potential modification of the standard clauses. For example, an agent specializing in complex commercial lines might require different liability and E&O stipulations than one focusing on personal auto and home policies. Similarly, an agreement for an agent working under an MGA will likely differ from one directly with a carrier.

Factors to Consider for Customization

- **Specific Product Lines:** Tailor clauses regarding product training, marketing materials, and compliance to the exact types of insurance products being sold.

- **Commission Adjustments:** Depending on the volume or type of business, commission structures might need tiered rates or specific bonus conditions.

- **Marketing Support:** Clarify who is responsible for marketing costs, lead generation, and brand usage.

- **Technology Access:** Detail access to agency management systems, CRMs, and other proprietary tools.

- **Client Servicing:** Outline expectations for client communication, policy changes, and claims assistance.

Taking the time to personalize your independent insurance agent agreement ensures that it accurately reflects the operational realities and mutual expectations of your specific relationship. It transforms a generic document into a powerful, bespoke contract that truly serves as the backbone of your professional collaboration, safeguarding the interests of both the agent and the agency.

A robust, customized agreement doesn’t just protect you legally; it forms the bedrock of a trusting and efficient working relationship. By addressing all potential areas of friction upfront and outlining clear expectations, both parties can move forward with confidence, focusing their energy on growth and client satisfaction. Investing the effort into a well-crafted agreement now will undoubtedly save time, resources, and potential disputes in the future, fostering a much more harmonious and productive partnership.