Navigating the complexities of healthcare costs can often feel overwhelming, leaving many patients anxious about how they will manage their medical bills. When faced with significant expenses not fully covered by insurance, or for procedures where payment is required upfront, a clear and fair solution becomes paramount. This is where a well-structured medical payment plan agreement template can be a lifesaver, providing a clear roadmap for both patients and healthcare providers to ensure financial obligations are met without undue stress.

These agreements aren’t just about paying bills; they’re about fostering trust and ensuring continued access to necessary care. For patients, it offers a manageable way to afford treatment, breaking down large sums into smaller, more digestible installments. For providers, it establishes a reliable system for collecting outstanding balances, reducing administrative burden and preventing accounts from going to collections.

By setting out the terms and conditions in advance, everyone involved understands their responsibilities, promoting transparency and minimizing potential misunderstandings down the line. Let’s delve into why having such an agreement is so crucial and what makes an effective one.

Why a Medical Payment Plan Agreement is Essential

In an ideal world, medical care would be accessible and affordable for everyone without financial strain. However, the reality often presents a different picture, with deductibles, co-pays, and uncovered services creating substantial financial hurdles. A medical payment plan agreement serves as a vital bridge in these situations, offering a structured approach to settling healthcare debts. It transforms a daunting lump sum into a series of manageable payments, making essential medical services financially viable for a broader range of patients. This arrangement not only provides peace of mind for individuals but also ensures that healthcare providers can continue to offer their services sustainably.

For patients, the primary benefit is clear: affordability. Instead of facing an immediate, large bill that might be impossible to pay, they can work with their provider to establish a schedule that fits their budget. This flexibility prevents delays in treatment due, allowing them to focus on their recovery rather than overwhelming financial worries. It also helps maintain a good credit score, as timely payments on a structured plan are far better than defaulting on a large, unexpected bill.

Healthcare providers also reap significant advantages from implementing these agreements. It drastically improves the likelihood of collecting outstanding balances that might otherwise go unpaid. By offering a flexible payment solution, providers demonstrate empathy and a commitment to patient care beyond the clinical setting. This can lead to increased patient satisfaction, stronger patient-provider relationships, and even better patient retention, as individuals are more likely to return to a facility that has shown understanding and flexibility during difficult times. Moreover, it streamlines administrative processes, reducing the need for extensive follow-ups and collection efforts.

Key Components of an Effective Agreement

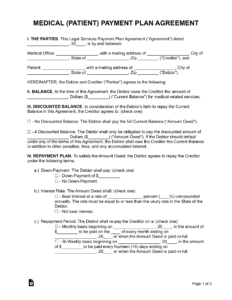

Creating an agreement that is both fair and enforceable requires careful attention to detail. A robust medical payment plan agreement template should clearly outline all the necessary information, leaving no room for ambiguity. This clarity is not only for legal protection but also to ensure both parties fully understand their commitments.

Here are the essential elements you should expect to see:

By including these comprehensive details, the agreement becomes a legally binding document that protects both the patient’s financial well-being and the provider’s ability to collect payment for services rendered. It transforms a potentially stressful financial discussion into a transparent and manageable process for everyone involved.

Creating Your Own Agreement: Tips and Best Practices

When it comes to putting together a medical payment plan agreement, while a template provides an excellent starting point, tailoring it to specific situations is crucial. Every patient’s financial circumstances are unique, and a one-size-fits-all approach might not always be the most effective. The goal is to strike a balance between the patient’s ability to pay and the provider’s need to recover costs. Begin by clearly stating the total amount owed and then engage in an open discussion with the patient to establish a realistic payment schedule. Consider factors like income, other financial obligations, and the patient’s comfort level with different payment frequencies and amounts.

It’s also highly advisable to have a clear policy on how late payments or defaults will be handled before the agreement is signed. Transparency on these aspects can prevent future disputes and ensures that patients understand the full scope of their commitment. While you might want to avoid immediate punitive measures, outlining the steps that will be taken, such as reminder notices or, in more severe cases, referral to collections, is important. Always ensure that the language used in the agreement is straightforward and easy to understand, avoiding overly technical or legal jargon that might confuse patients.

Finally, remember that communication is key throughout the entire process. Before asking a patient to sign, walk them through each section of the medical payment plan agreement template, explaining what everything means and answering any questions they may have. Encourage them to ask questions and express any concerns. A patient who fully understands and feels heard is far more likely to adhere to the payment schedule and maintain a positive relationship with your practice.

Implementing well-crafted payment plan agreements is more than just good business practice; it’s a testament to compassionate patient care. These agreements foster an environment where patients can receive the care they need without crippling financial burden, and providers can sustain their operations effectively. By proactively addressing payment solutions, healthcare organizations can build stronger relationships with their communities.

Ultimately, providing accessible and flexible payment options through a clear agreement helps bridge the gap between necessary medical treatment and financial feasibility. It ensures that both patients and healthcare providers can move forward with confidence, contributing to a healthier and more financially secure future for everyone involved.