Starting a Limited Liability Company (LLC) with a partner is an exciting venture, full of potential for growth and shared success. While the legal structure of an LLC offers fantastic benefits like liability protection and pass-through taxation, many new entrepreneurs overlook a critical document that can make or break their partnership: the operating agreement. It is the backbone of your business, especially when you have two owners.

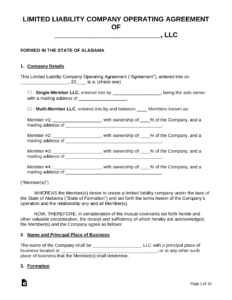

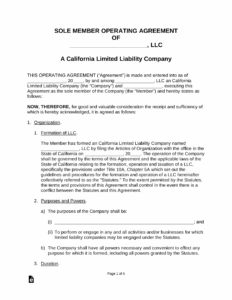

For two-person LLCs, having a clear, comprehensive, and legally sound 2 member llc operating agreement template is not just a good idea; it is absolutely essential. This document serves as a foundational contract between you and your business partner, defining how you will operate, make decisions, handle finances, and resolve disputes. Without it, you are essentially flying blind, relying on state default rules that might not align with your vision or expectations.

Think of an operating agreement as the instruction manual for your business partnership. It outlines the responsibilities of each member, their financial contributions, how profits and losses will be distributed, and what happens in various scenarios, from daily operations to significant changes like one member wanting to leave or the business needing to dissolve. It formalizes your understanding and protects both your personal and business interests.

Why Your Two-Person LLC Absolutely Needs an Operating Agreement

Even with just two members, an LLC is a complex entity, and the relationship between its owners is even more so. A well-drafted operating agreement clarifies the structure and prevents misunderstandings that could easily escalate into costly disputes. It ensures that both partners are on the same page regarding the vision, mission, and day-to-day operations of the company. It serves as a living document that guides your interactions and decisions, making sure that your partnership remains harmonious and productive.

One of the most crucial functions of an operating agreement for a two-member LLC is dispute resolution. No matter how well you get along with your business partner, disagreements are inevitable. Without a predefined process for resolving these issues, a minor dispute can quickly derail your business. The operating agreement can stipulate how deadlocks will be broken, whether through mediation, arbitration, or a clear voting mechanism, saving both time and potential legal fees.

Finances are often a contentious area in any business. Your operating agreement explicitly details each member’s capital contributions, how additional capital calls will be handled, and most importantly, how profits and losses will be allocated. This ensures transparency and fairness, preventing one partner from feeling undervalued or exploited. It can also outline how distributions will be made, whether regularly or only under specific conditions.

Furthermore, the agreement clarifies the management structure. Will both members have equal say in all decisions, or will one take on a more active role in daily management? It defines the scope of authority for each member, especially when it comes to binding the LLC to contracts or making significant financial commitments. This level of detail is critical, as it prevents either partner from overstepping their bounds or making decisions without proper consensus.

Finally, an operating agreement addresses what happens in significant life events, such as one member wanting to sell their interest, becoming disabled, or even passing away. It can include “buy-sell” provisions that dictate how a member’s interest can be transferred, ensuring the continuity of the business and protecting the remaining member. This forethought can save a business from dissolution during challenging times.

Key Sections to Look For in Your Template

- Capital Contributions and Interests: Details what each member contributes and their ownership percentage.

- Profit and Loss Distributions: Explains how financial gains and losses are shared among members.

- Management and Voting Rights: Outlines decision-making processes, member roles, and voting power.

- Meetings of Members: Specifies how and when meetings will be held.

- Buyout and Transfer Provisions: Defines what happens if a member leaves, dies, or wants to sell their interest.

- Dissolution of the LLC: Establishes procedures for winding down the business if necessary.

- Indemnification: Protects members from personal liability for certain business actions.

- Amendments: Describes the process for modifying the operating agreement in the future.

Customizing Your 2 Member LLC Operating Agreement Template for Success

While a 2 member llc operating agreement template provides an excellent starting point, remember that it is merely a framework. The real power of this document comes from tailoring it to the unique circumstances, goals, and working relationship of your specific business. Cookie-cutter agreements rarely fit perfectly and can leave significant gaps that might surface as problems later on. Take the time to discuss every clause with your partner, making sure it accurately reflects your mutual understanding and expectations.

Open and honest communication between both members is paramount during the customization process. This is your chance to lay out all your cards, discuss potential scenarios, and agree on how you will handle them. Consider the worst-case scenarios and plan for them, not because you expect them to happen, but because having a plan in place provides peace of mind and clarity. This collaborative effort in drafting the agreement often strengthens the partnership itself, as it forces both parties to think critically about the business’s future.

It is highly advisable to have your customized operating agreement reviewed by a qualified attorney. While a template can get you 90 percent of the way there, a legal professional can identify any missing provisions, ensure compliance with your state’s specific LLC laws, and help clarify any legal jargon. Their expertise is invaluable in protecting your interests and ensuring the document is legally enforceable and robust enough to stand up to any challenges.

A thoughtfully created and legally sound operating agreement is more than just a piece of paper; it is a vital tool for safeguarding your business and your partnership. It provides the clarity, structure, and foresight needed to navigate the challenges and celebrate the successes that come with running an LLC with another person. Investing the time and effort into this document now will undoubtedly pay dividends in the long run, contributing to a stable and thriving business environment for both members.